As the U.S. economy appears to be improving, discrete manufacturers are getting ready to invest in quality as a new survey shows increases in planned spending on test, measurement and inspection equipment, software and services.

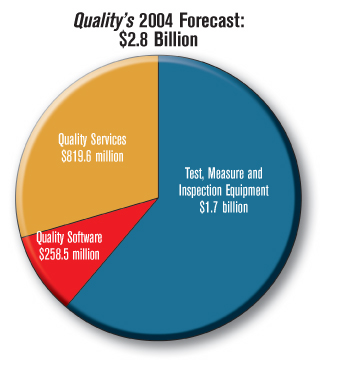

According to Quality magazine's 4th Annual Quality Spending Survey, discrete manufacturers will spend $2.76 billion in 2004, or an additional 10.4% more, on test, measurement and inspection equipment, software and services than they did in 2003. During 2004, expenditures per plant are forecast to rise to $70,889, as compared to $64,220 forecast for 2003.

Of the nearly $2.8 billion projected to be spent in 2004, almost $1.7 billion is earmarked for test, measurement and inspection equipment. This category includes: coordinate measuring machines ($153 million); form and surface measurement equipment ($51.7 million); gages and gaging systems ($677.9 million); optical inspection and measurement equipment ($152.5 million); color and coatings thickness ($44.8 million); materials and product testing equipment ($325.7 million); and a catch-all, "Other" category ($277.5 million). The Other category includes calibration equipment, data collection devices, and laser and laser alignment systems.

More than 61% of those surveyed will spend less than $10,000 on test, measurement and inspection equipment. However, due to large purchases, especially by the largest manufacturers, the average dollar amount spent on this equipment is projected to be $43,212 per plant.

Sales of software are projected to reach $258.5 million. The software sales will come in relatively small chunks, as manufacturers will spend an average of $1,250 per plant.

Expenditures on services are expected to reach $819.6 million and the average dollars spent is projected at $21,042 per plant.

In all, nearly a quarter of those surveyed will spend more than in 2003, and about two-thirds will spend the same amount. Only 10% of those surveyed say spending will decrease in 2004 as opposed to 2003. Of the 171 companies who said they would increase spending, more than 8 out of 10 of them will spend at least 6% more in 2004 than this year. Of the 43 companies who said they would decrease spending next year, more than 9 out of 10 will decrease spending by at least 6%.

Reducing costs and improving productivity appear to be the main reasons that people are buying this year. The most-often cited reason for the investment was to reduce scrap and rework, which was identified by 55.9% of manufacturers surveyed. Other important reasons for investment include improving productivity, which was named by 56.6% of those surveyed, and to reduce costs, which was named by 54.7%. In a potentially related motive, complying with ISO quality systems was the fourth most-often picked reason for making the investments.

What are they buying?

The biggest category for projected equipment spending is gages and gaging systems, which includes 14 types of gaging equipment such as air gages, ball gages, handheld tools, plug and ring gages, and thread gages. Manufacturers are budgeting about $678 million for gages, with handheld measuring tools such as calipers and micrometers, being the biggest area of purchase with about $223 million budgeted.

In terms of specific types of equipment spending, the biggest expenditures will be for calibration equipment, which is expected to reach $171 million, fixtures and special tooling gages, which is projected to hit $96.6 million, materials test equipment, which is projected to hit $72.4 million, plug and ring gages, projected at $71.4 million and data collection devices at more than $68.7 million.

The biggest software expenditure will be for calibration, projected at $46.8 million, ISO 9000 software at $34.3 million and data collection at $28.6 million.

In terms of services, about $465.3 million is projected to be spent for consulting and training services in 2004 and $354.3 million for test, measurement and inspection services. In the consulting and training services category, the biggest expenditures will be for certification and registration, which is projected at $207.3 million or more than three times the amount budgeted for quality management services. Sales of quality management services are projected at about $67.9 million.

Who's spending?

Historic trends held true in this year's survey, with the biggest spenders remaining the same no matter the industry, region or employee size.

The electric and electronic manufacturing industry (SIC 36) plans to spend the most, as it has the past four years, with $673.1 million slated to be spent in 2004. The vast majority, approximately $436.9 million, is earmarked for test, measurement and inspection equipment. Sales of software to this market niche is projected to be $58.7 million and sales of services is projected to be $177.5 million.

Manufacturers who produce rubber and miscellaneous plastic products (SIC 30) plan to spend approximately $120.1 million, with more than half, $66.7 million, earmarked for equipment, $12.6 million slated for software and $40.9 million slated for services.

Manufacturers who are in the primary metal industries (SIC 33) plan to spend $134.8 million, with $69.9 million planned for equipment, $17 million for software and $47.9 million for services.

Fabricated metal products manufacturers (SIC 34) plan to spend $253.1 million in 2004, including $135.8 million for equipment, $26.6 million for software and $90.8 million for services.

Manufacturers who are classified as "Machinery, except Electronic" (SIC 35) are scheduled to spend $486.2 million in 2004, including $245.2 million for equipment, $55.3 million for software and $185.7 million for services.

Transportation equipment manufacturers (SIC 37) have budgeted more than $604.3 million in 2004, including $404.5 million for equipment, $58.8 million for software and $140.9 million for services.

Manufacturers of instruments and related products (SIC 38) have budgeted $380.5 million, including $199.5 million for equipment, $30.3 million for software and $150.6 million for services.

Midsize companies spend the most

Quality's survey shows that overall, companies of 100 to 249 employees will spend the most in 2004. This is logical because that category has the second biggest base of companies with more than 9,000 plants in Quality readership, and by correlation the biggest base of companies industry wide. Only the smallest companies, those with less than 50 employees, have a bigger base with more than 13,000 shops identified.

Keeping varied base sizes in mind, companies with fewer than 250 employees plan to spend more than $1.4 billion in 2004, or more than half of all projected expenditures.

Here is a break out of projected sales by company size:

- Manufacturers with less than 50 employees have budgeted $391.5 million, including $222.8 million for equipment, $45 million for software and $123.6 million for services.

- Companies with 50 to 99 employees have budgeted $312.5 million, including $179.4 million for equipment, $33.9 million for software and $99.2 million for services.

- Those companies with 100 to 249 employees are forecast to spend $700 million, including $436.4 million for equipment, $57 million for software and $206.7 million for services.

- Companies with 250 to 499 employees have budgeted $385.4 million, including $226.2 million for equipment, $31.6 million for software and $127.6 million for services.

- At the larger end of the market, companies with 500 to 999 employees are scheduled to spend $423 million, including $254.2 million for equipment, $41.4 million for software and $127.4 million for services.

- Companies with more than 1,000 employees have budgeted $641.7 million, including $431.1 million for equipment, $58.5 million for software and $152.1 million for services.

The survey method

Quality magazine would like to thank all the respondents who participated in the 4th Annual Quality Spending Survey.

Quality magazine is mailed to more than 64,000 manufacturing engineers, quality assurance supervisors, and other professionals in 38,950 plants. Questionnaires were mailed in August 2003, to managers and other professionals who hold the highest degree of equipment purchasing influence in a representative sample of 5,000 plants. The cutoff date for returning the surveys was Sept. 26. Surveys were returned by 972 professionals for a response rate of 20%. To estimate 2004 spending data, responses were weighted to the number of plants in each industry served.