Laser tracker equipment has been in existence for three decades, used widely in the automotive, aerospace and machine shops sectors for larger volume and high accuracy measurements. According to the working principle of a laser tracker, the system transmits a laser signal to a target that is retroreflective (meaning it reflects light back to its source with limited scattering) and is held against the object that is to be measured. The reflected light repeats the same path and re-enters the tracker, which helps the distance to be calculated using an interferometer. The functional use of the tracker is used primarily for distance measurement by collecting coordinate data, which in turn creates an accurate replicate on a local coordinate system. Hence, the laser tracker is often used in multiple positions to gather entire information about the required object.

Throughout the major sectors that use laser tracker equipment, each uses them for their own unique reasons. For example, key applications in the automotive sector include alignment, profiling, dimensional measurement, and control. The small size of laser trackers, combined with their large volume measurement capabilities, drive their need in the automotive sector. In the aerospace, military, and defense sector, laser trackers are used for inspecting the curved surfaces of aircraft wings, part inspection, reverse engineering, and dynamic measurement. Laser trackers are preferred over other metrology solutions because of their portability and speed, along with the need in the aerospace, military, and defense sector for accurate measurement of critical components. With steady improvements in software capability, the growth of laser trackers is promising. Overall, portability and speed drives demand for laser trackers in both the automotive and aerospace end user market.

Market Overview

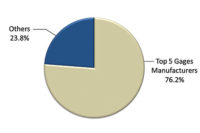

The dimensional metrology industry has hundreds of companies participating across different levels of the value chain to capitalize on market opportunities across different technology platforms. However, the laser tracker market has been relatively unexplored by a large number of market participants. A majority of the market share is strongly held by two leading competitors - Hexagon Metrology and FARO Technologies, with approximately 86 percent of the total market share in 2012. The below article will analyze the factors behind this quasi-monopoly/oligopoly with an overview of the global laser tracker market.

Frost & Sullivan research indicates that the global laser tracker market generated revenue of $129.0 million in 2012. This represented a growth of 5.3 percent over 2011 revenue. Hexagon Metrology led the competition with a market share of slightly over 50 percent of the global laser tracker market, followed closely by FARO Technologies.

Product Highlights

Hexagon Metrology’s Leica Absolute Tracker AT901 is offered to customers in three different form factors—basic, mid- and long-range. The mid-range and long-range forms support the integration of accessories such as the T-probe, a breakthrough product for the automotive industry due to its accuracy and reliability. Another product of Hexagon Metrology, Lecia Absolute AT401, can be operated without a warm-up period. Product features include full speed digital read out (DRO) for dynamic laser tracker measurement processes and free-form surface inspection. The product can be operated outdoors or in adverse climatic conditions. Leica Geosystems’ product line is a key factor behind Hexagon Metrology’s continued dominance of this market.

FARO Technologies’ Vantage laser tracker is extremely portable and even comes with a carry case which looks similar to a backpack. FARO’s Vantage is integrated with a two–camera system that can automatically point to a specific object, and quickly locate an object when it is not in its normal position. The in-line optics provide accurate measurement capability of long-range and large objects from one position. The product is also certified by International Protection Rating-IP52 for using the equipment outdoor for measurement. FARO’s Ion is an interferometry based measurement system. These two products pose tough competition to other leading competitors in the laser tracker market.

Besides the above mentioned tier-1 companies, only a handful of others, such as API Sensor and Northern Digital Inc, are actively involved in this industry. API Sensor holds the maximum market share in the tier-2 segment. The quasi-monopoly structure is expected to intensify the competition and challenge the tier-2 companies to remain relevant in this industry. In the future, competitive pressures are expected to increase the trend toward acquisition of tier-2 market participants for enhancing market share in the laser tracker market.

Tactile Probe Solutions Will Lead to Sustainable Growth

Leading companies have designed their laser tracker portfolio to be easily integrated with accessories such as probes and scanners providing reliable measurement results. Research indicates that scanners have limitation in measuring edges of objects and holes. On other hand, a tactile probe swiftly even scans and tests covered points. For tier-1 companies, laser trackers with probes generate more than 80 percent of the overall company’s revenue. A high-accuracy level is essential for automotive and aerospace and defense applications and probing solutions are considered the major source of accessories for the laser tracker.

For accessories’ technologies, Hexagon Metrology and API Sensors have engaged in strategic partnership with Steinbichler Optetechnik GmbH. Hexagon Metrology provides PROBEscanner for T-Probe users. With the scanning options available without interrupting the tracker, there is increasing demand for PROBEscanner. Similarly, API sensors have introduced SmartScan in May 2010. This is used for large-scale objects and can be automated as well. Such strategic partnerships indicate that market participants are trying to leverage external expertise to provide high-quality integrated solutions and keep the cost low and standardize investment for such niche markets.

Europe Expected to Sustain Its Key Position as the Top Geographic Market

The European and North American regions generated revenue of 35.2 and 32.2 percent of the global laser tracker market respectively in 2012. In both of the regions, the presence of aerospace, automotive and machine shops generate a substantial proportion of the overall revenue. United States is the world’s biggest consumer and exporter of military hardware, thus demand for laser trackers from this sector is expected to be fairly strong for next three years.

The Asia Pacific market generated 27.0 percent of the global laser tracker market revenue. The increase in outsourcing manufacturing to Asian countries is estimated to be the primary growth factor in this region. The market is expected to showcase marginal growth for next three years.

Quasi-Monopoly Market Structure Leads to No Premium Pricing

During the economic downturn in 2009, the global laser tracker market revenue fell by 3.6 percent provoking a nervousness which decimated the profit margins of all market participants. During that period, market participants slashed the product prices by 20 to 30 percent in order to drive market adoption. However, marginal product differentiation further intensifies competition and narrows profit margins. The average price of a laser tracker varies between $90,000 and $120,000 based on the applications, specifications, sophistication, capability, measuring ranges, inspection process, and accuracy. Market participants observe that the popular models are typically priced at approximately $110,000, which includes the hardware and software cost. The pricing pressure in this market is presently estimated to be medium in nature as the low level of product differentiation and quasi-monopoly market structure provides no scope for premium pricing.

In comparison to other technologies such as coordinate measuring machines, white-light scanners and vision measuring machine based products, prices of laser trackers are relatively higher. Typically, mid-sized end users with limited inspection and maintenance budgets may not be able to justify expenses of $110,000 for a laser tracker solution. As a result, customers tend to opt for cost-effective metrology solutions, which further challenges market growth.

Conclusion

It is evident that the presence of market leaders such as Hexagon Metrology, FARO Technologies and API Sensors has raised the bar in terms of technology and product development for laser trackers. Their global presence and technology innovation has helped these companies consistently stay ahead of the competition. Furthermore, the competition amongst the leaders enunciates the need for high-accuracy laser trackers along with new accessory technologies that increase measurement flexibility thereby exhibiting reliable measurement results.

Additionally, strategic alliances with external vendors will bring about best in class technology to the market. Consequently, this will transfer research and development costs of accessory technologies to third party companies. This further affirms that market participants have cautiously built their cost-effective laser tracker business segment.

Europe and North America are the lucrative regions for laser trackers and an increased concentration of end users in these markets is expected to bring in more business opportunities for high-end integrated laser tracker solutions. On the other hand, Asia is expected to remain the market that purchases low-cost/ standalone equipment for the next five years. Tier-2 companies from the Asian region will continue to generate business opportunities in the low-cost/ standalone laser tracker equipment segment; however this demand for low-cost/ standalone laser tracker equipment will not change or challenge the quasi-monopoly state of the global laser tracker market.

|

TECH TIPS

|