Although initially developed as a method for detecting defects in structures in order to safeguard against catastrophic failures, ultrasonic non-destructive testing (NDT) has evolved immensely to a technique considered the mainstay for the NDT industry. Today, ultrasonic NDT is not only capable of detecting surface and subsurface defects, but also quantifying these defects. Apart from defect detection, ultrasonic NDT is also utilized in the industrial world for thickness gaging. There has been a rapid evolution of ultrasonic NDT with game changing technological advancements being witnessed in the past decade. This article will provide a brief history in time to understand important technological advancements that have shaped the ultrasonic NDT industry to its current state. The article will also provide an overview on the market for ultrasonic NDT covering the competitive landscape and an outlook for the future.

A Brief History in Time

In the 1940s, Floyd Firestone, Donald O. Sproule and Adolf Trost respectively started independent research on the industrial ultrasonic testing in the United States, Great Britain (GB) and Germany. Each worked unaware of the others activities, as they all worked in secret. Sproule and Firestone found partners for their instruments and gave birth to two organizations: Kelvin-Hughes and Sperry Inc. Although Firestone, Sproule and Trost were the pioneers of industrial ultrasonic testing, the industry has been defined by work done by two other well-known names; Josef Krautkrämer from Cologne and Karl Deutsch from Wuppertal. In 1949, Krautkrämer and Karl Deutsch came across information on the Firestone-Sperry instruments through technical papers and started developing their own instruments. Within a year both Krautkrämer and Deutsch incorporated their companies, and these are still regarded as having a huge legacy in the industry.

After the initial developments in the field of industrial ultrasonic testing carried out by both Krautkrämer and Karl Deutsch a number of other companies emerged into the market such as Siemens and Lehfeldt in Germany, Kretztechnik in Austria, Ultrasonique in France and Ultrasonoscope in Britain. They all stopped their production before the 1970’s, including Kelvin-Hughes. Other companies such as Nukem in Germany, Gilardoni in Italy, Panametrics and Stavely in USA, Sonatest and Sonomatic in GB, and Mitsubishi in Japan lasted longer. Sonatest, Gilardoni, Sonomatic and Mitsubishi still exist with varying success. Panametrics and Nukem were acquired and integrated into larger corporations.

The industrial ultrasonic testing industry was relatively dormant till the 1990s when the industry was reinvigorated realizing the advantages computers could offer. Since then a few techniques have been developed with phased array and time of flight diffraction (TOFD) being the most popular. Because these two technologies work so well together, other techniques, like synthetic aperture focusing technique (SAFT), fell by the way side. Although, within the past decade, guided waves has been the most important industry development and is expected to be the next big thing in ultrasonic testing. These techniques have shaped the flaw detection segment of the ultrasonic testing industry.

Thickness gauging has been a less glamorous participant of the industrial ultrasonic testing industry over the past decade with major breakthroughs achieved by the 1990’s. In the 1950’s, early ultrasonic testing instruments were commercialized and were primarily used for flaw detection, yet could also be used for thickness gauging. They were extremely large and immobile instruments. In the 1960’s, the portable variants of thickness gauges appeared on the market with digital displays, rather than oscilloscope screens. However, the true innovative breakthrough was achieved in 1970’s by Panametrics who developed handheld multi-mode measurement thickness gauges. During this decade these thickness gauges became truly compact, powered by batteries. The 1980’s witnessed further miniaturization of the thickness gauges, while the 1990’s witnessed increasing reliability of the instruments with analog circuits replaced by digital circuitry. Since then, the thickness gauges have steadily improved to the current crop of sophisticated, easy-to-use powerful instruments reaching impressive performance levels.

Market for Ultrasonic NDT Equipment

As mentioned above, the 1950’s witnessed the birth of commercialization of industrial ultrasonic NDT instruments with Krautkrämer and Karl Deutsch receiving early success. Krautkrämer became the market leader in 1960’s and has been a force to reckon with in the industry ever since. The company now operates under GE Measurement and Control Solutions. Panametrics started operations in 1960 and pioneered work in ultrasonic thickness gauging instruments. It also developed innovative flaw detectors, thus giving tough competition to Krautkrämer since its inception. Today, Panametrics operates under Olympus NDT brand and is the market leader in the ultrasonic NDT equipment market. There are more than 50 companies in the market providing ultrasonic NDT equipment, but Olympus NDT and GE Measurement and Control Solutions are the largest participants with Sonatest a distant third. The other notable participants in the market are Sonotron NDT, Technology Design Ltd (operating under Oceaneering), Zetec Inc, CN Doppler, SIUI, Danatronics and Sonomatic.

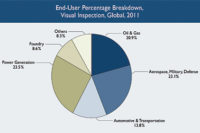

Frost & Sullivan research estimated the ultrasonic NDT equipment market at $434.6 million in 2011 growing at a compounded annual growth rate of 7.2 percent, and is expected to reach $615.5 million by 2017. From an end-user industry perspective oil and gas and power generation are the biggest markets for ultrasonic NDT equipment contributing 29 and 24.4 percent respectively in 2012. Aerospace, military and defense is the next biggest segment accounting for 15.8 percent of the market.

The key growth driver for the ultrasonic NDT equipment market is high oil and gas prices. The Brent Crude oil prices have remained fairly high since 2011 and dipped below $100 a barrel only once in June 2012. The US Energy Information Agency (EIA) forecasts the prices to remain above $100 till 2014. It is expected these high prices will translate into greater income for the oil operators which in turn would be invested in new projects for exploration, transportation and refineries. The biggest restraint for the market is high replacement rate for the equipment. The average life for portable ultrasonic NDT equipment used in field applications subject to harsh environment conditions is approximately five years. In a bid to save on cost, the end users try to use an instrument for six to seven years. The high replacement rate thus means that ultrasonic NDT equipment market has a six year cycle.

Outlook – The Future for Ultrasonic NDT Equipment

The past decade in ultrasonic NDT equipment has been dominated by phased array ultrasonics with the first portable phased array instruments being introduced in the early 2000’s. Ever since the introduction of portable equipment, the ultrasonic NDT market exploded into growth. Along with phased array, TOFD has received considerable recognition over the past decade, especially due to its benefits in complimenting and operating in conjunction with phased array to offer better performance. At the moment, a majority of the R&D work is focused on TOFD and phased array-with key developments witnessed in high end phased array instrumentation. The portable market is relatively mature and the only advancements in the portable instruments are being made on faster operation and better battery performance. Another ultrasonic NDT technology that received recognition in the industry over the past decade was guided wave ultrasonics. Currently most major market participants are investing in developing a solution for guided wave ultrasonics. This is considered the future direction for product development strategies.

Another technology that is being researched in a number of institutes is known popularly as total focusing method (TFM) or volume focusing method. This is not a standalone ultrasonic technology; however it’s a refinement of phased array ultrasonic testing. In classical phased array ultrasonic, the elements in the array are pulsed together. However, in TFM, one element is pulsed at a time and received on all other elements within the array. At the moment this technique takes a while to traverse the full object under test; however it presents a better picture of the object enabling views from a number of angles. This technique for phased array is in the research phase, however actual commercialization of this technique is expected to happen soon and the market should start accepting it in five years.

Currently, guided wave ultrasonic is expected to drive product development strategies, while TFM phased array is expected to be the future of ultrasonic NDT equipment.