A lot has changed since March 2020.

That’s when the last Quality State of the Profession survey was conducted. The survey was fielded March 9-10, 2020. The next day, WHO declared COVID-19 a pandemic, and it was declared a national emergency in the U.S. a few days after that. This year’s survey reflects the changes wrought by the pandemic as well as ongoing issues in the quality field.

While COVID-19 was a top challenge, the quality profession remains strong, as respondents said they enjoyed their work despite barriers such as skilled labor shortages and quality compliance initiatives.

This year’s survey reflects those changes. Clear Seas Research, in conjunction with Quality, has conducted a State of the Profession study in order to provide detailed information on professionals involved in quality operations.

As in the past, the goals of the study were to learn about trends in employee compensation, hours and job constraints; overall job satisfaction; improvements to quality; and a demographic profile of industry professionals. This year the survey delves into the impact of COVID-19 on your operations during the past year.

Quality Expert Offers Her Take On The Profession

Quality expert Grace Duffy offers her take on the 2021 Quality State of the Profession survey results. Learn what your peers in the industry are working on now.

A Closer Look

Before we begin talking about the survey results, let’s take a look at who responded to the survey. Who is in the industry?

Quality management is the job function most held by the respondents, followed by quality engineering. Nearly half of respondents hold an engineering-related job function.

More than three-quarters of respondents indicate quality focused roles are a part of their manufacturing department, followed by nearly two-thirds with quality roles in operations.

The respondents are an experienced group, with a mean of 23 years in the quality manufacturing industry. Twenty-eight percent have been in the industry for more than 30 years. Only 10% have been in the field for less than five years.

With all of that experience comes some supervisory responsibility. Fifty-nine percent supervise 10 people or less.

In Good Company

More than one-third of respondents are involved with components/parts manufacturing and OEM manufacturing. Respondents manufacture products for various industries, from aerospace (31%) to primary metal (4%).

Two-fifths of respondents’ companies report their 2020 annual revenue to be $100 million or more. The median company revenue is $44 million.

More than half of respondents’ companies employ 500 or fewer employees including all locations. Quality staff size remained mostly consistent during the past year, though one-third of respondents reported a decrease.

All of the respondents have manufacturing locations in the United States. Fifty-two percent have manufacturing operations only in the U.S.

For companies with other locations, they have three countries/regions on average. Top locations besides the U.S. were China (26%), Mexico (25%) and Canada (21%). Other locations include Germany, the United Kingdom, India, Brazil, France, and Japan.

Satisfaction & Compensation

Not surprisingly, COVID-19 restrictions/safety guidelines topped the list of challenges expected ahead. Forty-eight percent anticipated being affected by it. Other job barriers were skilled labor shortages (45%) and quality compliance initiatives (40%). Interacting with suppliers and time constraints rounded out the list of the top five concerns.

What contributes to job satisfaction? Ninety-three percent of respondents said the job overall is the most important factor that contributes to their job satisfaction, followed by their company’s commitment to quality. This aligns with past years as well.

Other significant factors include: work environment, pay, benefits, corporate leadership, and opportunities for advancement.

While compensation is a big factor at any job, it is worth noting that this came in at fourth on the list, mentioned as extremely important for 79% of respondents, which was the same for benefits. What is the average salary? This year respondents earned, on average, an annual salary of $90,000. More than half of respondents receive an annual bonus. Of those, the average amount is about $10,000.

And even during this unusual time, more than half of respondents report a salary increase compared to the past year, on average by 5%. Fifty-nine percent expect a salary increase at their next performance review.

And how satisfied are respondents? The news is good: 80% said they were extremely satisfied with their job overall. On the other end of the spectrum, the professional surveyed are an ambitious group: only 47% said they were satisfied with the opportunities for advancement.

They are also looking to improve their skills. Workforce skill improvement was ranked the largest job-related concern. The following were also top concerns: economic conditions, salary and management support. Respondents were less concerned about company mergers or acquisitions, outsourcing, privatization, and automation. It’s worth noting that even during a pandemic, economic conditions and salary were still not the most important concern.

In terms of companywide improvement, respondents also had some ideas. After all, quality professionals are in the continuous improvement field. They believe companies should focus first on improving training, hiring new labor, developing sales growth, and/or improving quality assurance over the next year.

New technology is definitely a part of improving quality. Respondents are adopting a range of technologies, from robots to cloud computing to automation, but 41% prefer to wait to adopt a new technology until others use it. One-third are willing to be early leaders.

And how do responds think COVID-19 will affect their work going forward?

One-in-five respondents were not concerned with the impact COVID-19 will continue to have on their business.

For those who weren’t concerned, they listed reasons such as vaccine availability now. For some, their business grew during the pandemic. One wrote, “We are an essential business; we grew by almost 30% last year to the needs of our customers.” However, three-in-ten were still very concerned with COVID-19’s continued impact. (With the survey fielded March 11-15, this may have changed.) One respondent wrote, “Access to people and customers is limiting our work”

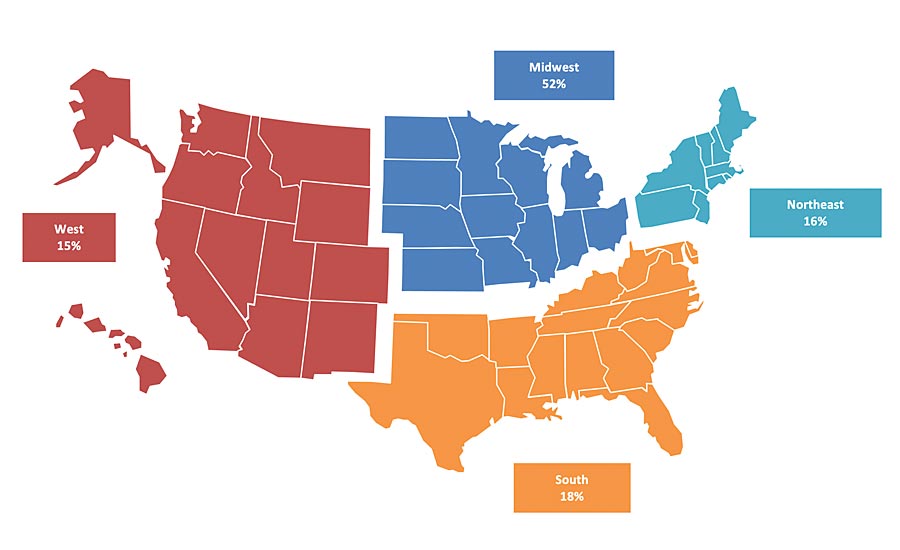

Survey respondents in the US by region. (Click on image to enlarge.)

Survey respondents in the US by region. (Click on image to enlarge.)

Respondent Profile

Let’s take a closer look at the survey respondents. The mean age is 54 years old, and 84% are male. Forty-two percent have a bachelor’s degree. The largest group (52%) are located in the Midwest, followed by the South at 18%, the Northeast at 16%, and the West at 15%.

The survey had a 1.2% response rate and 205 complete surveys. Each respondent received a $10 gift card. Thank you to all those who participated. We appreciate hearing your thoughts during this time.

Michelle Bangert is the managing editor of Quality.