Frost & Sullivan’s analysis of the global industrial digital radiography market valued the industry at approximately $350 million in 2013. Having initially lost some momentum to other NDT techniques such as ultrasonic inspection due to market reluctance to go digital, growing customer awareness as well as productivity and cost benefits have seen this segment grow at a healthy rate of approximately 8-10% year-on-year. As a nondestructive testing (NDT) tool, digital radiography is one of the fastest growing segments, driven by advances in hardware, such as tubes, sources, and detectors, as well as upgrades in software that have considerably improved the user-friendliness and efficiency of x-ray inspection systems.

Industrial digital radiography is comprised of three main technologies—computed tomography (CT), direct radiography (DR) and computed radiography (CR). Each of these products and markets has their own unique characteristics and challenges. Through this article, Frost & Sullivan will analyze the current state of each of these markets by highlighting key drivers and macro-economic trends that influence demand for these solutions.

Computed Radiography—Steady Growth Forecasted

Often described as the gateway to digital imaging, CR imaging is similar to film-based radiography except that instead of film, imaging plates made of photostimulable phosphor are used. These imaging plates are then scanned by a reader using laser technology which digitizes the image and stores it on a computer. However, after the introduction of CR in the 1990s for industrial inspection, the rate of technology advancement has been relatively slow and the lacking availability of personnel capable of operating CR systems is still a concern.

According to Nils Kah, managing director at Dürr NDT, people working in this environment have limited knowledge about digital radiography. “In terms of image quality and applicability, I think CR is capable of replacing conventional film anywhere. But the lack of personnel is a problem. It always boils down to if the customer has the right personnel. Several customers are still working with analog techniques; they have very little understanding of IT software and are not well trained with computers. So if you want to introduce CR you have to change your personnel and that’s the biggest challenge right now.”

To overcome this challenge Dürr NDT revamped its HD-CR 35 system in 2013. The HD-CR 35 is the ideal system for customers that are apprehensive about making the transition from film to digital. In addition to being the lightest scanner in the market, the onboard display and integrated mini-PC functions eliminate the need for it being connected to a laptop or PC. Also, after the scan has taken place the quality of the image can be checked on the in-built display which allows the image to be verified for acceptability and further interpretation. As a result, technicians with relatively limited experience and qualification can operate this system.

Recently, with worrying global economic trends, particularly in Europe, demand for CR systems is expected to face some rough weather. Frost & Sullivan’s research indicates that the global CR market for NDT applications generated approximately $90 million in 2013 at a growth rate of 5-6%.

Direct Radiography—Key Markets to Continue Driving Demand

Direct Radiography refers to the use of a flat panel detector (FPD), where digital x-ray sensors are used instead of traditional photographic film. Although the use of digital x-ray for nondestructive applications has been around for decades, unlike previous techniques, the true benefits of digital technologies can be realized by DR. While computed radiography (CR) ushered in the era of digital radiography by simplifying the image archiving and analysis process, improvements related to reduction of workflow steps and productivity were limited. DR also eliminates the need for harmful image processing chemicals, which, in addition to the ability to view images immediately on a computer console, greatly improves inspection throughput making DR the ideal inspection tool for manufacturing and production environments.

A major end user concern with direct radiography is the fragility of the FPDs especially in harsh onsite environments such as remote oil refineries or pipeline applications. Also, the cost of replacing these FPDs can be deterrent with prices ranging between $40,000-125,000 for amorphous silicon (a-Si) detectors and $25,000-65,000 for complementary metal–oxide–semiconductor (CMOS). The price of the FPDs has a considerable impact on the overall price of the DR system. Although this price has steadily declined it still limits widespread adoption of this technology. However, early adopters such as the automotive and aerospace sectors, where the need to conform to high industry standards for quality and safety is paramount, continue to realize the benefits of DR in manufacturing and maintenance applications. Research indicates that the global DR market for NDT applications is valued at approximately $75 million and is the fastest growing segment in industrial digital radiography.

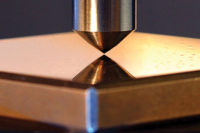

Computed Tomography—Merging NDT and Dimensional Metrology

CT has become relatively common as an NDT tool but in recent times, over the last 5 years in particular, it is increasingly being recognized as a solution for dimensional measurement. In principle, the operation of a CT system is similar to DR with respect to the image acquisition process; however, with the help of software, the object can be reconstructed to provide a 3-D view of internal and external structural details with final output being a 3-D volumetric model. The 3-D image can then be manipulated and sliced in various ways to provide thorough understanding of the structure.

While CT systems have been used in the metrology field for a few years, a majority of currently available solutions have their roots in medical applications. Historically, medical grade CT systems have found it difficult to replicate the repeatability and accuracy requirements of industrial environments. With rapid advances in technology and improvements in the source, detectors and software, metrology-grade CT systems are increasingly being adopted. “In the 1880s tactile metrology was prevalent. In the 1980s optical measurement came up, including laser and white light technology. In the beginning of this century, CT and x-ray will take it to the next level,” said Stefan Moll, Yxlon International GmbH’s president of X-ray systems.

According to Moll, 3-D is the next natural step. “Nowadays everybody does 3-D. The world will be 3-D— from televisions to 3-D printing. Industry 4.0 will ask for more data and seeing the data in 3-D will be the next logical step, which will drive CT into all markets.”

However, this market is faced with several technical and market related challenges. There is a need for flexibility which is unachievable with currently available CT systems. Measurement of large-sized parts, improving the speed of scans and quality of the final 3-D representations using specific software modules are the key unmet needs of the customer.

Cost also appears to be a limiting factor with the average price of CT inspection system estimated to be more than $330,000. However, Moll argues that this depends on the application. “We are in a different phase from CMMs. Technology is evolving quite fast and customers tend not to be price sensitive but to be a step ahead in terms of technology.”

Although, similar to CR, the lack of skilled operators is a key area of concern for Yxlon. “Lack of skilled technicians is a limiting factor. To use CT effectively in metrology, you need a CT expert and a metrology expert. So you have to melt those two competencies in one person which is not easy to find.”

Conclusion

The shift from analog to digital has given the radiography market a new lease on life for NDT and measurement applications. While film will continue to play an important role in NDT inspection, the trend toward digital x-ray is undeniable. Despite the market challenges, be it CR, DR or CT, improvements in technology have made x-ray inspection easier, faster and a lot less expensive, which is only expected to further boost demand for these solutions.