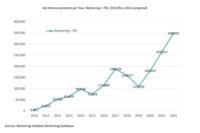

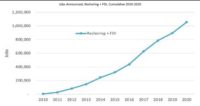

CHICAGO — The Reshoring Initiative, an organization committed to helping manufacturers recognize the profit potential of utilizing local sourcing and production, has published its annual data report on reshoring trends, and the news is good. More than 60,000 manufacturing jobs were brought to the United States by reshoring and foreign direct investment combined in 2014, representing a 400 percent increase since 2003.

With only 30,000–50,000 jobs being offshored to other countries in 2014, the resulting net gain of 10,000 or more jobs per year represents a shift in the right direction. By comparison in 2003, the United States lost net about 140,000 manufacturing jobs per year to offshoring. The steady decrease in the number of jobs lost, capped by a net gain last year, is building confidence that reshoring and FDI are important contributing factors to the country’s manufacturing rebound.

Data for this report comes from the Reshoring Initiative’s Reshoring Library of more than 2,000 published articles, privately submitted reshoring case studies and some other privately documented cases. The report provides data and analysis in 13 different categories ranging from the number of manufacturing jobs lost to offshoring and reasons cited for reshoring to a breakdown of data by industry, country, region and state. It also includes an international summary of cases reshored to other countries

Of particular interest are the reasons companies gave for reshoring and FDI. Government incentives, the skilled workforce, capitalizing on the value of a "Made in USA" label, and automation topped the list in 2014. At the same time, companies cited lower quality, long lead times, high freight costs and rising wages as reasons against offshoring.

The data also indicates that reshoring was strongest in the Southeast and Texas, a trend consistent with The Boston Consulting Group’s forecast for those areas to lead the way in becoming competitive with China for the manufacture of products to be sold domestically. Much of this is attributed to the trend for companies to build “green-field” factories in states with lower wages, lower taxes and right-to-work laws.

“We publish this data annually to show companies that the trend in manufacturing in the United States is to source domestically,” said Harry Moser, founder and president of the Reshoring Initiative. “With 3 to 4 million manufacturing jobs still off shore, we see huge potential for even more growth and hope this data will motivate more companies to reevaluate their sourcing and siting decisions.”

The Reshoring Initiative offers many tools and resources to help companies make supply chain sourcing decisions. The Reshoring Initiative’s Total Cost of Ownership Estimator is the best-known publically available tool for this purpose. It uses advanced metrics that allow users to easily determine the total cost of offshoring by accounting for and understanding the relevant offshoring costs, which include inventory carrying costs, shipping expenses, intellectual property risks and more.

For more information, visit www.reshorenow.org