Our 15th Annual State of the Profession Survey offers a glimpse inside the minds of quality manufacturing professionals, from the equipment used and hours worked to salary and job satisfaction. Job satisfaction, hours worked and equipment purchases all seem to be holding steady, according to this year’s respondents. Despite the job constraints and ongoing challenges, the good news is that quality professionals are happy with their work. Read more to learn how you compare to your peers in the industry.

Company Overview

The respondents came from many different industries, with aerospace leading the group at 15% of respondents, followed by fabricated metal products (12%); medical equipment and supplies (10%); motor vehicle body, trailer and parts (9%); and miscellaneous manufacturing (8%). The remaining categories, each with 5% or less, included: electrical equipment, appliances and components; energy industry; machinery; plastics and rubber; test and measurement equipment; computer and electronics products; furniture and fixtures; primary metals; and transportation equipment.

TECH TIPSSurvey respondents came from many different industries, with aerospace leading the group at 15% of respondents. This was followed by fabricated metal products (12%); medical equipment and supplies (10%); motor vehicle body, trailer and parts (9%); and miscellaneous manufacturing (8%). Forty-seven percent of respondents reported being extremely satisfied with their work, while 48% said they were moderately satisfied. |

Forty percent of respondents work at an OEM, a third come from component manufacturers, and 16% work at a job shop. Company revenue is healthy. Thirty percent of respondents’ companies have annual revenue between $10 and $49.9 million. The median company revenue is $20 million. More than two-thirds of respondents come from companies with 500 or fewer employees. The mean company size was 4,734 employees, and the median was 175. For the most part, the quality staff sizes have remained the same (46%) or increased (40%) in the past year.

When it comes to quality-related purchases, the quality assurance team is in charge, with 53% of respondents saying they primarily handle these decisions. Those with primary purchase responsibility have the following tasks: 32% determining the need, 28% recommending brands or models, 24% approving the purchase or expenditure, 8% developing product specifications, and 5% placing the order.

The Plan for Resources

In looking ahead to next year, half of the respondents do not plan to commit more resources to quality, while 41% said they did. Of those who anticipate an increase in resources, most plan to spend it on gages, at 63%, and quality software (which is new to the survey this year), at 62%. This was followed by measurement software (31%), CMMs (27%), laser measurement equipment (24%), form/geometric measurement equipment (23%), optical comparators (18%), surface finish measurement equipment (18%), video measurement equipment (12%), measuring microscopes (10%), gear measurement equipment (9%), shaft measurement equipment (6%), and white light/structured light (5%). Two respondents also mentioned increasing personnel.

When it comes to embracing new technology, 41% said they would wait until others used it before adopting it themselves. Ten percent said they were willing to be on the leading edge, and 32% said they would be an early leader. On the other end of the spectrum, 17% said they would likely be one of the last ones to use it.

While almost all respondents have production in the United States, the next most common locations were China (30%) and Mexico (21%). Other top locations were Germany, Canada, the United Kingdom, India and Brazil. About half of respondents (54%) only have production locations in the U.S., which was up from last year’s 49%.

Meet the Employees

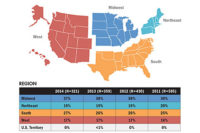

Now let’s learn more about the employees themselves. They are located across the country, with almost half of respondents hailing from the Midwest (44%). The South followed at 21%, the West at 19%, and the Northeast at 16%.

The average age of respondents is 53 years old. Eighty-one percent of respondents are male. In terms of education, only 1% have a PhD. The largest group has a bachelor’s degree (39%), followed by 21% with a master’s, 16% with an associate’s degree, 13% with a certificate program and 11% with a high school degree.

More than sixty percent of respondents do not have an ASQ certification nor Six Sigma green belt or higher.

The majority of respondents are in quality management (36%) or quality engineering (28%), followed by engineering at 11%, corporate/executive management at 6%, manufacturing engineering at 5%, and manufacturing operations/production/supply chain management at 5%. Only 3% are in the R&D department and 2% in purchasing.

Most respondents have been at their current company for 16 years or less. Sixty-eight percent have been in the industry for more than 16 years; the mean is 22 years. Two-thirds of respondents have supervisor responsibilities, and the majority supervise less than five people.

Hours Worked

And they are at work more than the average work week. About half (53%) work between 40-45 hours per week, and only 23% said they work forty-hour weeks. Twenty-six percent said they work forty-six to fifty hours per week, and 20% said they work more than 50 hours. For most respondents (74%), there has been no change in hours worked, but for 20% their hours have increased, by an average of seven hours per week. Looking ahead to next year, 76% expect their hours to remain the same while 20% expect an increase. This seems to be stabilizing, as last year more respondents expected their hours to increase.

The quality-related responsibilities cover a range of tasks, with implementing solutions to problems (70%) and interfacing with management (69%) being the top projects.

Of course, as with any task, there are job constraints. This year, time constraints were cited by 54% as one of the biggest projected barriers for next year. Management support followed at 40%, along with the skilled labor shortage at 38%.

But despite the constraints, respondents are busy taking action. Sixty-five percent of respondents are a member of a quality team or committee, with most focusing on new processes, new product development and productivity.

Job Satisfaction

And how satisfied are respondents with their work? Things look good. Forty-seven percent reported being extremely satisfied, while 48% said they were moderately satisfied. Only 5% said they were not at all satisfied.

Of course, many different factors contribute to job satisfaction, with “a feeling of accomplishment” being the most important (cited by 60%). Other attributes followed such as technical challenge (43%), good relationship with colleagues (42%), and salary (42%).

Economic conditions (cited by 48%) and management support (45%) were selected as the top job concerns, followed by job security (30%), sufficient operating budget (26%), keeping current on technology (25%), salary (24%), keeping current on regulations (22%), and outsourcing/privatization (12%).

A Look at Salary

In terms of salary, the median salary is $74,977. More than half of respondents receive an annual bonus, with an average bonus of just under $8,000. More than half of respondents reported a salary increase during the past year, by an average of 6%. Fifty-seven percent of respondents expect that their salary will increase at their next performance review.

For those whose salaries have not increased, the top reasons were budget constraints and economic conditions. The overall company performance was the most common reason for a change in salary (72%), followed by the respondent’s performance review at 61% or their plant’s overall operating performance at 47%.

Benefits and Training

Of the benefits provided, 91% of respondents’ companies provide paid vacation, 87% provide health insurance, 79% provide dental insurance, 76% provide 401(k) matching, 74% provide life insurance, and 67% provide vision insurance. Other company benefits listed include tuition reimbursement, flexible hours, on-the-job training, profit-sharing, pension, stock purchase plan, and childcare. Seventy-one percent expect to pay more for health insurance premiums next year.

Sixty-five percent of respondents have received training in the past year, with the top training related to certifications; ISO, FDA or regulatory standards; or management. The skills to develop next year include certifications, time management and problem solving.

Methodology

Thank you to everyone who filled out this year’s survey. BNP Media’s Market Research division conducted the survey on behalf of Qualityin order to learn more about today’s quality professional. The survey was sent to a systematic random sample of active Qualitysubscribers. It was fielded March 24 to April 10, 2015, and received a response rate of 1.56%, with 220 useable responses.