With the ability to automate processes and improve productivity across disparate industries, machine vision has never been more important. Both in and beyond the factory floor, customer needs continue to expand and evolve, but suppliers have risen to the challenge by expanding the capabilities of machine vision technology in lockstep.

The following provides a look into some of the latest trends in machine vision, in terms of both technologies and applications. This includes the growing importance of deep learning, increased automation in logistics and warehousing, and advances in robotic pick-and-place technologies.

Transformative Technologies

Over the past few years, the increasing need for automation has been highlighted by COVID-19 disruptions, labor shortages, supply chain issues, rising inflation, and political tensions. In many cases, these businesses didn’t or still don’t have the necessary manpower to run the business. Luckily, machine vision systems represent a way for companies of all types to keep the lights on, while also increasing efficiency and driving revenue.

By way of example, in 2021 — in the face of an uncertain economy — the North American machine vision market reached a record high of $3.02 billion in orders, eclipsing the previous record of $2.87 billion in 2018. Orders in cameras, lighting, optics, imaging boards, and software grew across the board, as did application-specific machine vision systems and smart cameras.

As part of its Big Ideas 2022 research report, ARK Investment Management identified 14 transformative technologies that could potentially change the way the world works. In this year’s report, the 14 technologies were as follows: robotics, AI, autonomous mobility, Internet of Things, blockchain, cloud computing, mobile connected devices, 3D printing, battery technology, reusable rockets, gene sequencing, gene editing, living therapies, and digital wallets.

Many of these technologies can be seen on exhibit floors at trade shows like Automate and The Vision Show. ARK forecasts that the total enterprise value of these technologies will grow from $14 trillion in 2020 to $210 trillion in 2030. One major example of several of these technologies coming together — including the Internet of Things, robotics, AI, autonomous mobility, and cloud computing — is in the logistics and warehousing space.

Toward Full Warehouse Automation

When it comes to a convergence of the latest machine vision developments, perhaps no better example exists than logistics and warehousing. The modern-day warehouse likely features several different types of machine vision and automation technologies, including robots, automated guided vehicles (AGVs), autonomous mobile robots (AMRs), 2D and 3D vision, deep learning, and advanced LED lighting.

A fully automated warehouse, for instance, can deploy a mix of different technologies that carry out all operations, from receiving goods to fulfilling orders. After an online order is placed, for instance, software directs a mobile robot to autonomously retrieve a bin or tote from its storage location and bring it either to a human employee or a vision-guided robot (VGR) for order fulfillment. In the latter scenario, the VGR uses vision to pick the item from the bin and place it in the appropriate container. At a minimum, such a setup involves AMRs with safety sensors and 3D vision and a piece-picking robot that uses 3D vision.

One common challenge in logistics involves detecting and sorting packages ranging in size from small envelopes to 1 m boxes. Companies such as Amazon and Walmart use portal systems in automated warehouses where goods travel from the receiving area on a conveyor for order fulfillment. The variation in package size on the conveyor, however, presents issues because the portal is located at a fixed distance and height from the line. Lighting and focus settings for a large box or a small flat pack will vary greatly, but suppliers have pushed the technology forward by offering tunable field of view lights that dynamically adjust the projection distance and can turn on in less than 500 ns — while boxes move at fast rates — to address depth of focus for the camera and bring the application to life.

Diverse 3D Imaging Developments

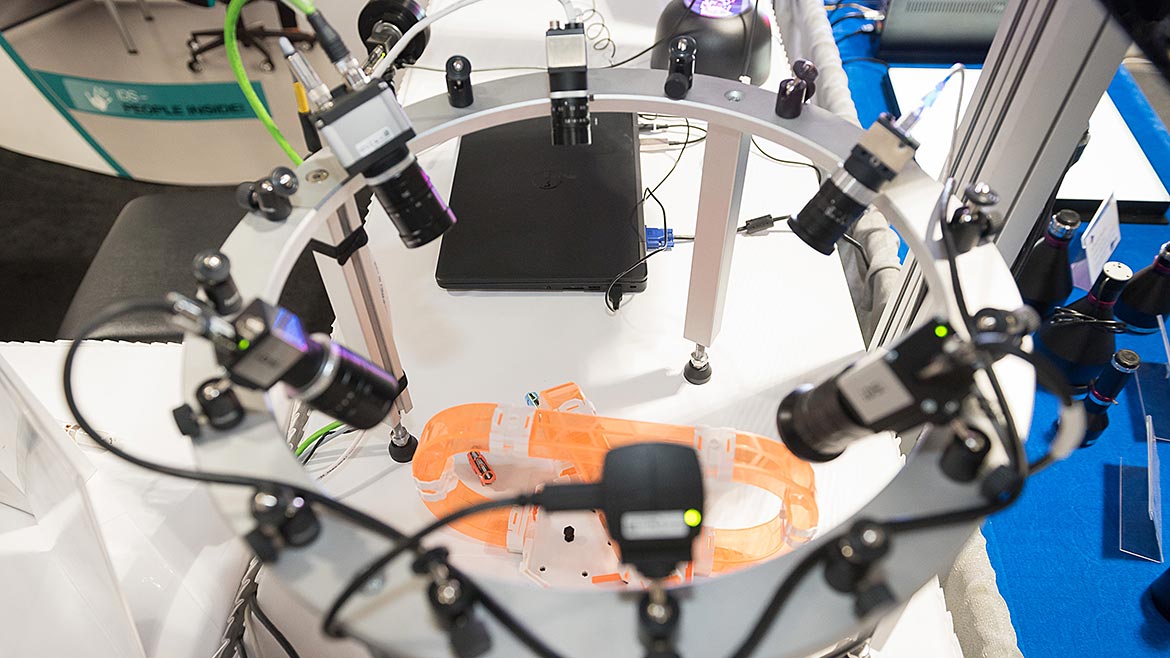

Robotic pick-and-place technology has made significant strides over the past few years that have benefitted applications beyond logistics and warehousing. Many companies across various manufacturing sectors deploy VGRs for picking objects from one location and precisely placing them elsewhere. In addition, picking randomly oriented items from a bin (known as “bin picking”) is an application that has also reliably served many companies for years.

Certain bin picking challenges have emerged over the years, however, as customer needs grow. For instance, if parts are loose, randomly piled, cluttered, stacked, or mixed, it can be difficult for the system to differentiate between the parts much less pick them up. In addition, the demand for quality and speed have increased. Again, however, machine vision suppliers have responded by advancing the capabilities of several key technologies, including 3D imaging.

First and foremost, 3D imaging represents one of the fast-growing technologies in machine vision, with today’s solutions more compact and affordable than ever before. The 3D cameras available today deliver lower noise, higher resolution, higher accuracy, and higher speeds than their predecessors. In addition, more types of 3D imaging solutions exist than ever before. This includes stereo vision, time-of-flight, laser line scanning, and structured light.

One recent trend in bin picking and piece picking involves 3D imaging systems combining with deep learning/machine learning software to solve unique challenges such as picking from vast numbers of SKUs, picking randomly oriented or irregularly shaped objects, or picking objects the system hasn’t seen before. These items could be small consumer goods, food products, medical products, or any range of different parts. Some suppliers in the machine vision space already offer fully integrated pick-and-place and bin picking systems that utilize deep learning and feature robots, 3D vision, and AI technology built into the system and ready for immediate deployment.

Deep Learning Settles In

Deep learning has become increasingly popular in automated inspection applications in the manufacturing space as well. For years, deep learning has been something of an enigma in this space. In addition to being initially overhyped — possibly as a replacement for traditional machine vision approaches — deep learning may have been intimidating due to it being a ‘black box,’ where it’s difficult to understand at first glance the inner workings of the individual convolutional neural nets.

As deep learning software has become more mature and available on the market, and as the understanding of how deep learning works continues to grow, manufacturers have found applications for which the technology is a good fit. When training data, proper image labeling, ample resources, and a consensus on defining defects are required, deep learning can add tremendous value for manufacturers looking to perform tasks such as semiconductor and electronics inspection, packaging, and automotive manufacturing, to name a few.

Advancing, Ad Infinitum

Automation in general is being deployed at record rates because it is helping companies of all sizes, in all industries, be more productive and globally competitive. The technologies outlined here represent just a handful of recent advances and trends that have helped companies innovate and drive revenue. Traditional machine vision technologies including rules-based algorithms, 2D cameras, and barcode readers continue to reliably serve companies of all types, all over the globe, at ever-increasing rates.

As always, machine vision suppliers continue to meet the evolving needs of end users and customers, and the overall automation space benefits — finding new ways to increase productivity and efficiency, protect against current and future disruptions, and ultimately drive revenue.