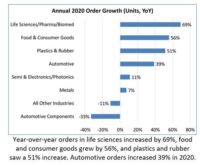

North American companies ordered fewer robots in the first quarter of 2023 than for the same period last year. According to the latest report from the Association for Advancing Automation (A3), companies ordered 9,168 units valued at $597 million in Q1 2023, a 21% drop in total units and a 10% drop in value over the same quarter in 2022, which was the third-best quarter on record for North America.

Automotive customers accounted for 68% of all robot orders in Q1, with 5,659 robots purchased. During Q1, non-automotive orders in consumer goods, semiconductor & electronics, plastics & rubber, life sciences/pharmaceutical/biomedical, metals, and others purchased 3,519 robots, down 42% over Q1 2022.

“While inflation and a slowing US economy may have taken a slight toll on robot orders overall, automotive companies continue to accelerate their purchases as they make the transition to manufacturing electric vehicles,” said Jeff Burnstein, president of A3. “Non-automotive companies are typically newer to automation and may be waiting to invest more until they’ve tested recent deployments or see the economy begin to recover. They also might be waiting to see the latest innovations in robotics at Automate 2023 next week in Detroit. We’re seeing big registration numbers from all industries and can’t wait to show everyone what’s possible with automation today!”

Despite the state of the US economy, labor shortages, led by the manufacturing industry, remain the key driver in the growth of automation. As a result, more manufacturers continue to turn to automation, especially to handle the “dull, dirty and dangerous” tasks unattractive to human workers.

“In addition to labor shortages, we’re seeing many U.S. manufacturers bring more tasks back to North America as international labor costs continue to climb,” said Alex Shikany, vice president of membership and business intelligence. “Many find that the best way to bring manufacturing back quickly is to automate.”

For more information, visit https://www.automate.org/.