March 2023 looked a lot different from March 2020.

Unlike March three years ago, we weren’t focused on a looming pandemic. And unlike March two years ago, we are no longer dealing with COVID-19 outbreaks affecting all aspects of our lives.

The 2023 State of the Profession Survey

Roderick Munro, our first Quality Professional of the Year as well as an experienced auditor, offers his take on the State of the Profession results. Listen to what surprised him about the survey, trends in quality, and how the pandemic affected the quality field.

Roderick Munro, our first Quality Professional of the Year as well as an experienced auditor, offers his take on the State of the Profession results. Listen to what surprised him about the survey, trends in quality, and how the pandemic affected the quality field.

Listen to more Quality podcasts.

This year’s State of the Profession survey was fielded March 23-27, 2023. Longtime readers of Quality know the survey is done to understand your peers in the industry. This year respondents had a different set of worries—and tools. Supply chain issues have replaced health and safety as a top concern, and new technologies are available. Respondents also expect the quality team to increase this year, always welcome news.

Clear Seas Research conducted the study on behalf of Quality in order to look at trends in terms of compensation, work hours, and job constraints; overall job satisfaction; and quality improvements, as well as provide a profile of industry professionals.

If you’re recruiting now, you’re in good company. Ninety-six percent of respondents’ companies are currently recruiting. And if you’re having trouble hiring, that is also the norm. According to respondents, finding new people is one of the top challenges.

While this remains an ongoing challenge, some challenges have faded. Namely, pandemic-related issues have subsided.

Would you like to see how various generations of quality professionals compare? Or how compensation trends for each sector? Perhaps what technologies are in use? Our dashboard tool allows easy comparisons between slices of the research. Visit dashboard.qualitymag.com/QSOP.

Here are the takeaways for 2023.

The Response

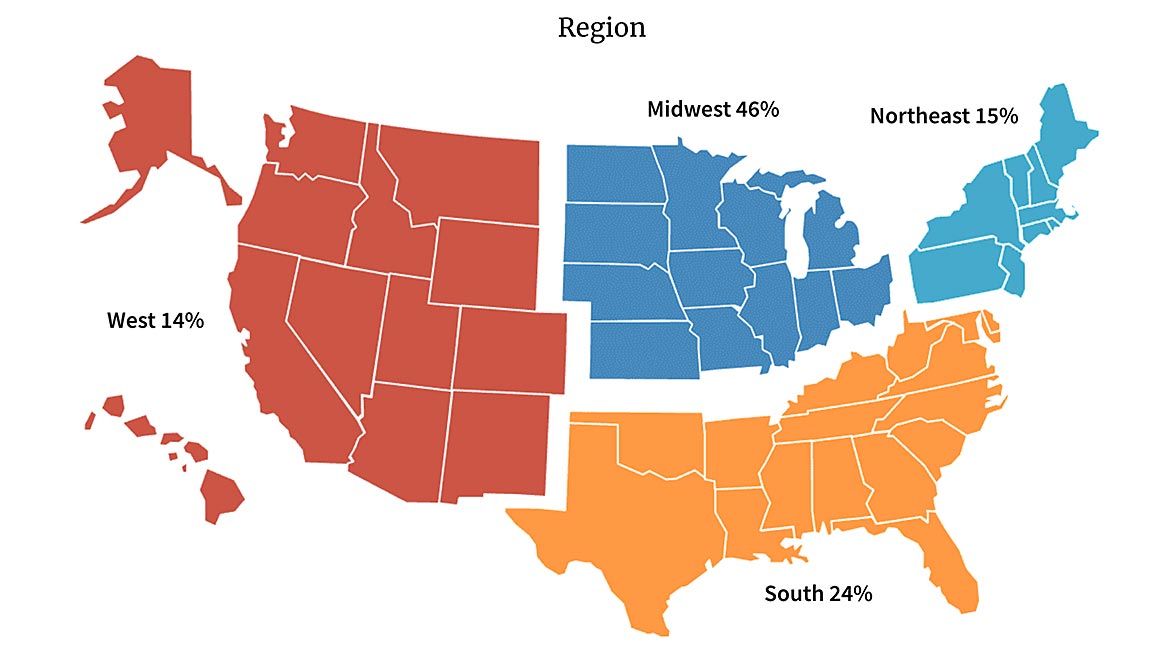

Before we look closer at the results, let’s take look at those who responded. The online survey was sent to active subscribers of Quality. Each respondent that participated in the study received a $15 gift card. We received 205 useable responses for a response rate of 1.47%.

Overall, it was a very experienced group, with an average of 24 years of experience in the industry. Almost a third of the group has been in the industry for more than 30 years. Only 5% have been in the quality manufacturing field for less than five years. With this experience comes responsibility. Seventy-seven percent are also supervisors, with more than three-quarters of respondents supervising 10 people or less.

Almost half of respondents work in an engineering-related role, while about a third have a quality management role.

The study was intended for those who are involved in quality manufacturing initiatives, and almost half of respondents reported being very involved in quality.

A Closer Look

Quality is important in every industry, but let’s see what respondents are manufacturing. While they came from various industries—the list is long—almost three-quarters were involved with components/parts manufacturing or original equipment manufacturing. Aerospace (30%), medical (25%) and transportation (24%) were the top industries mentioned, along with miscellaneous manufacturing categories (27%).

The companies are thriving too. The median company revenue is $28 million. Some companies are extremely profitable; more than one-third of respondents’ companies reported a 2022 annual revenue of $100 million or more.

In terms of company size, two-thirds of companies had 500 or fewer employees. Quality staff team size was mostly consistent. But this looks set to increase, or at least that is the hope. Almost one-third of respondents say they expect their quality staff to increase in 2023.

More help is always appreciated, especially with ever-present job constraints and barriers. The most worrying this year are supply chain interruptions, skilled labor shortages, and the current economy/inflation. More than half of respondents indicated these were the barriers expected to make the biggest impact. If supply chain interruptions are keeping you up at night, know that many other quality professionals have the same concerns.

Almost one-quarter of respondents said that supply chain interruptions and skilled labor shortages will have the largest impact, followed by the current economy/inflation.

Along with the struggles, there are also the rewards. The most important factor in job satisfaction is the job overall, respondents say, followed by the work environment, pay for the job done, their company’s commitment to quality, and the benefits package. Note that, as usual, pay is not the number-one factor. While the money is important, the job itself matters more.

And for the majority of respondents, they are satisfied with their job overall. (Four-in-five respondents). How could things be better? (As quality professionals, they would be remiss if they didn’t want to continually improve their work.) Their concerns include workforce skill improvement, salary, economic conditions, and management support.

This is for their own career. In zooming out and looking at the big picture, skilled labor shortages and lack of training were seen as the greatest concerns facing the quality industry.

Mentoring or trying to encourage the younger generation were some methods to address these issues.

Salary Situation

It’s time to talk numbers. This year respondents reported an annual salary of about $93,000, on average.

If you are among the nearly two-thirds of respondents who receive an annual bonus, you may be interested to know that the average amount is about $11,000.

And in more bright news, salaries are going up. Almost two-thirds of respondents reported a salary bump compared to the previous year, on average by 5%. And two-thirds also expect an increase at their next performance review. It sounds like things are going well in your overall work and compensation.

Help Is On The Way

In terms of recruiting, there are many ways to deal with the dilemma. Companies are mainly using company websites, job search engines/boards, word of mouth, temp agencies/recruiters, and internal recruitment.

Over the next year, this should be a priority, respondents say, believing that their companies should focus most on hiring new staff and addressing labor shortages.

In other words, respondents seem to be saying, “We could use some help.”

Technology is one way to get help. According to respondents, less than half of their companies are willing to lead with new technology. More than half wait for others to use a new quality technology before they do so. This question addressed their company’s attitude, so perhaps respondents themselves would be more willing to embrace new technology if it were solely their decision.

New technology is always on the way. More than half of respondents report that their companies are using automation and/or cloud computing. Other big technologies are additive manufacturing and robots—which should be no surprise to readers of Quality or even general interest news. Whether you saw the 60 Minutes segment on artificial intelligence or just have walked a trade show floor lately, it’s clear that technology continues to leap ahead.

Quality professionals are closely following these trends and ready to welcome new members to the field as well.

Thank you to all those who completed this year’s survey. We know your time is valuable and you have a lot of work to do, and we appreciate you sharing your thoughts.

Keep up all your hard work, and we look forward to checking in with you again for the next state of the profession survey.