Manufacturers, like many of the rest of us, held their pocketbooks mighty close, and in some cases closed, in 2009. When recessions come calling, manufacturing is often one of the hardest hit areas. Consumers stop spending, demand dries up and manufacturers are left in the thick of it all.

Many of us were affected, either directly or indirectly, by layoffs and/or pay cuts. The good news is that economists have deemed the recession over, and while it will take time for manufacturing to come around, the economy is already starting to see signs of recovery.

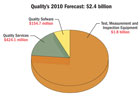

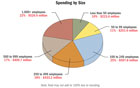

Playing it a bit more cautious with their budgets in 2010, respondents toQualityMagazine’s 10th Annual Spending Survey estimate the quality marketplace to be $2.4 billion in the upcoming year which equates to an average of nearly $56,000 per plant.

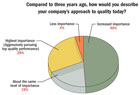

Along with many other industries, manufacturers are producing more with less. The principal motive for investments is to improve productivity for 61% of respondents, a 12% increase from last year. Other motives for investing in quality include to reduce scrap and rework, 56%; reduce costs, 55%; and ramp up for a new product, 48%.

Budgets

Taking a look back at 2008 projections of 2009 budgets vs. 2009 actual spending for quality assurance and control equipment, systems software and services, 62% of respondents projected budgets were on par with what was actually spent. Eight percent were over budget, which was down 5% from the previous year. And 30% were under budget, which is up 4% from the previous year.For those companies that were under budget, more than half were under budget by more than 20%. Of those, 43% were under budget by more than 25%. This can be attributed to the fact that when companies were contacted about their 2009 budgets in July 2008, the economy was relatively stable, but as the year progressed and conditions got worse, companies began to slash their budgets.

On the other side, of those expecting a decrease, 22% of respondents expect a budget decrease of 6% to 10%, while another 38% expect 2010 budgets to decrease by more than 25%.

Equipment Sales

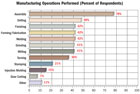

Equipment expenditures are expected to be around $1.8 billion in 2010. Nearly half of the survey respondents, 48.3%, plan to spend money on gages and gaging systems to the tune of $293.2 million. Handheld measuring tools, the workhorses of the industry, are projected to be at $78.6 million. For those companies investing in gages and gaging systems in 2010, the average amount is $14,425.In terms of dollars and cents, product testing equipment looks to be the largest category in 2010 with spending at an estimated $467.6 million. Of those spending money on product test equipment, nearly half of the money-$212.3 million-will be spent on environmental equipment while another $100.1 million is estimated to be spent on leak testing equipment.

Estimates for optical inspection and measurement equipment are $216.9 million for the upcoming year. The top three expenditures in this category are video measurement systems, $59.9 million; microscopes, $45.1 million; and machine vision systems, $43.4 million. A mainstay of the industry, optical comparators sales are expected to be $35.8 million.

Software Expenditures

When it comes to software, 13.3% of survey respondents said they plan to make a purchase in 2010. Software accounts for a $154.7 million piece of the quality pie. As in past years, data collection tops the list of software expenditures at $29.7 million. This is followed by statistical process control (SPC) software at $21.2 million.New to this year’s top five software expenditures is enterprisewide quality software at $16.2 million. Document control/management and calibration round out the top five at $13.0 and $12.8 million, respectively.

At $86.5 million, companies in the South, plan on spending more on software than the Northeast, Midwest and West combined. SPC software is the number one software expenditure in the South at $20 million.

Service Side

Quality services include consulting and training services, as well as test, measurement and inspection services. Overall spending for consulting and training services is expected to reach $175.3 million. Certification/registration is at the top of the consulting and training services that will be in demand to the tune of $56.8 million. This is followed by quality management consulting at $27.3 million and lean manufacturing consulting at $21.6 million.While companies of most sizes are looking to follow the consulting and training services trends, companies with 1,000 or more employees will be spending their money a bit differently. As would be expected with larger sized companies, those with 1,000 or more employees are looking to spend a good deal of money on quality management consulting and process improvement consulting at $6.3 and $6.2 million, respectively.

On the test measurement and inspection services side, calibration services lead the way at $169.2 million. At a distant second is lab testing services, $25.1 million, and materials testing services, $19.4 million.

Silver Lining

While manufacturers are cautious when it comes to 2010 budgets, there are a few areas where spending is expected to increase, some dramatically, in the upcoming year.When it comes to software, spending on software quality control (SQC) is expected to increase to $4.6 million, an astounding 269.8% increase from last year’s numbers. Enterprisewide quality software also is expected to rise 43.8% to $16.2 million.

In the test, measurement and inspection equipment, spending on environmental test equipment is expected to be $212.3 million, an increase of 88% from 2009 numbers. Another category expected to see a significant increase in 2010 is in-process turnkey gaging systems; they are projected to be up 73.3% from this year with spending at $11.4 million.

Other categories looking to see increases in 2010 include air gages, up 13.8%, and fixed limit gages, 12.1%.

When times get tough often the first budgets to be cut are those pertaining to consulting and training. Despite this, quality function deployment and quality management services look to buck the trend with increases of more than 8% in the upcoming year.

With 2009 nearly in the rearview mirror, many manufacturers are looking to 2010 and their investments in quality to bring a prosperous new year.

Survey Methodology

QualityMagazine would like to thank all of the respondents who participated in the 10th AnnualQualitySpending Survey. Questionnaires were e-mailed in late July 2009 to managers and other professionals who have responsibility for quality and hold the highest degree of equipment purchasing influence in a representative sample of 5,000 plants. Survey respondents were asked to share their spending plans for 2010. The deadline for responses was August 3, 2009.Surveys were returned by 639 professionals for a response rate of 5%. Respondents had the opportunity to win one of three $100 American Express gift cards as an incentive to complete the survey. To estimate 2010 spending data, responses were weighted to the number of plants in each industry served. This survey has a ±3.85 % margin or error.Q