When multisensor technology first made its way into the dimensional metrology industry, it was distinctive. Multisensor metrology typically comprised of a video-based measurement system fitted with additional probes, usually a touch probe. Currently, definitions are getting blurry, with multisensor systems not restricted to any one technology platform. Irrespective, this market continues to grow at a rapid pace.

This article will aim to analyze the factors that are driving this growth and the outlook for this market.

Current State of the Market

Frost & Sullivan’s recent analysis of the global multisensor systems market indicated that it generated revenues of $239.2 million in 2011, with forecasts predicting it to grow at a compound annual growth rate of 6.1 percent to approximately $320 million in 2016. With rapidly improving technology and superior features being incorporated into these systems with each passing year, industry participants expect this market to continue expanding. Within the vision-based measuring systems market, which also comprises of profile projectors and measuring microscopes, multisensor systems accounted for approximately 69 percent of total market and this market share is expected to grow to approximately 72 percent within the next 3 to 4 years.

Improvements in Sensor Technology

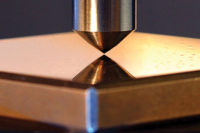

While there are a number of factors that have aided the growth of this market in recent times, the most obvious one is the wide array of commercialized sensor technologies currently available. End users are spoiled with a host of choices in contact and non-contact sensors available at their disposal. Obtainable options to the customer range from video or optical sensors, laser, scanning probes and tactile probes. The choice depends on the object to be inspected, speed of measurement, repeatability and accuracy. For example, while tactile probes are recognized for their accuracy, optical sensors are more adept at measuring edges, while scanning probes are preferred for contoured surfaces. Customers can also choose from a range of laser scanners depending on the type of objects to be measured – dark diffuse surfaces or highly reflective surfaces. Although there is an evident trend toward non-contact probes across a number of applications, touch probes are still considered very accurate. Renishaw has built its reputation around its top-of-the-line touch probes, which can be found on most multisensor systems currently available in the market.

At the end of the day the customer is looking to drive down costs and improve the quality of their manufacturing processes. A multisensor system does exactly that by improving the efficiency of the measurement process and eliminating standard bottlenecks.

Keeping Pace with Modern Manufacturing Processes

Another factor that has driven the adoption of multisensor systems is the level of excellence in today’s manufacturing processes. Components, especially in industries such as medical, aerospace and automotive, have complex and intricate shapes that must meet tighter tolerance requirements—making it difficult to measure with conventional measurement tools. Of course, complex components have existed for decades and in the past manufacturers have used multiple measurement techniques to certify the geometry of the part—from customized gages and check fixtures to expensive in-house metrology solutions. In certain cases, dimensional measurement had to be completely disregarded due to the lack of available metrology solutions.

In the frenetic pace of today’s manufacturing environment and cut-throat competition, this no longer remains an option. In order to achieve the highest quality, customers look at using the best and most advanced metrology technique available to reinforce their brand image. Companies are willing to invest in expensive metrology equipment in order to achieve products of the best quality. For instance, in industries such as medical devices, electronics and automotive where geometric dimensioning and tolerancing (GD&T) is vital to manage component complexity, multisensor systems are expected to play a critical role. This is proven through Frost & Sullivan’s research that indicates that 87.2 percent of the total revenue generated by the multisensor systems market in 2011 was generated from these industries.

Is a Multisensor System for Everyone?

The value that a multisensor system can bring to the measurement process is undeniable. The ability to take multiple measurements with one setup appears to be an engineer’s dream come true. But one factor that needs to be carefully weighed in is the cost. Currently, multisensor systems are almost exclusively used for high-speed, high-throughput, repetitive applications; where the investment in a multisensor system is justified by the improvement in manufacturing efficiency over time.

As mentioned earlier, the advancement in sensor technology has been critical to the development of the multisensor product line. However, it should be noted that the addition of a few extra sensors results in an exponential increase in the price of the system. A regular vision measuring machine with a value in the range of approximately $50,000 could almost double in cost with the addition of non-contact sensors such as a white-light scanning probe or a laser probe. It is therefore critical for a customer to have an intimate knowledge of the measurement requirements and the inherent tradeoffs that exist between cost and performance. This educational gap is evident in the market, as customers are still not fully aware of the benefits of multisensor systems and current solutions available in the market to meet their quality requirements.

The high-price point of multisensor systems is currently its biggest market deterrent to wide-scale market adoption. Frost & Sullivan research indicates that less than 5.0 percent of total market revenues come from developing countries. Although multinational organizations in BRIC countries are an exception, a number of local manufacturing companies involved in orthopedic implants or automobile components for example, are not able to afford these systems as they cannot justify the expense.

Threat to Multisensor Systems?

The multisensor systems market is a highly competitive market with the top three market participants accounting for approximately 60 percent of the global market share. Companies such as Optical Gaging Products, Mitutoyo Corp., Micro-Vu Corp. and Nikon Metrology have consistently stayed at the forefront of this industry by providing consistent value additions to their product line.

The biggest threat to the multisensor system vendors, though, is not from within this market, but from competing technologies that claim to offer faster, more accurate and cheaper alternatives. In particular, companies such as Keyence, through their IM-6500 Series range of solutions are menacing to displace multisensor systems, by offering high precision systems at a relatively low price. Although the IM-6500 is not the ideal system for high throughput applications, the low price point of these types of solutions make it an attractive solution for manufacturing companies with limited quality and inspection budgets.

Conclusion

Technology has been a driving force in propelling multisensor systems to its current status. However, challenges and potential for improvement still remain. Software continues to remain a key concern for vendors, especially with the influx of non-contact sensors in multisensor systems, where volumes of data need to be analyzed by skilled operators. Vendors are currently working on tighter integration between multiple software packages for improved usability and operation.

Currently, no one sensor exists that can meet all the sensing requirements of a metrology systems. Despite the numerous advantages of multisensor systems, there are several drawbacks, including cost implications and technical complexities that hinder the progress of this market. In the future it is possible that this industry can revert back to single sensor systems with an all-in-one sensor that can revolutionize the landscape of dimensional metrology. Q

Vijay Mathew is Program Manager with Frost & Sullivan.