FRANKFURT, Germany — By 2020 more than 1.7 million new industrial robots will be installed in factories around the world. Today, the strongest growth in the robotics industry is in Asia – lead by China as the world´s number one marketplace.

In 2017, robot installations are estimated to increase by 21% in the Asia-Australia region. Robot supplies in the Americas will surge by 16% and in Europe by 8%.

Important drivers of this development: Robot adoption is a response to faster business cycles and the requirement to produce with greater flexibility tailored to customer demand in all manufacturing sectors. A new generation of industrial robots will pave the way for ever more flexible automation. So says the 2017 World Robotics Report, as published by the International Federation of Robotics (IFR).

"Robots offer high levels of precision and their connectivity will play a key role in new digital manufacturing environments,” says Joe Gemma, president of the International Federation of Robotics. “Increasing availability enables more and more manufacturers from companies of all sizes to automate.”

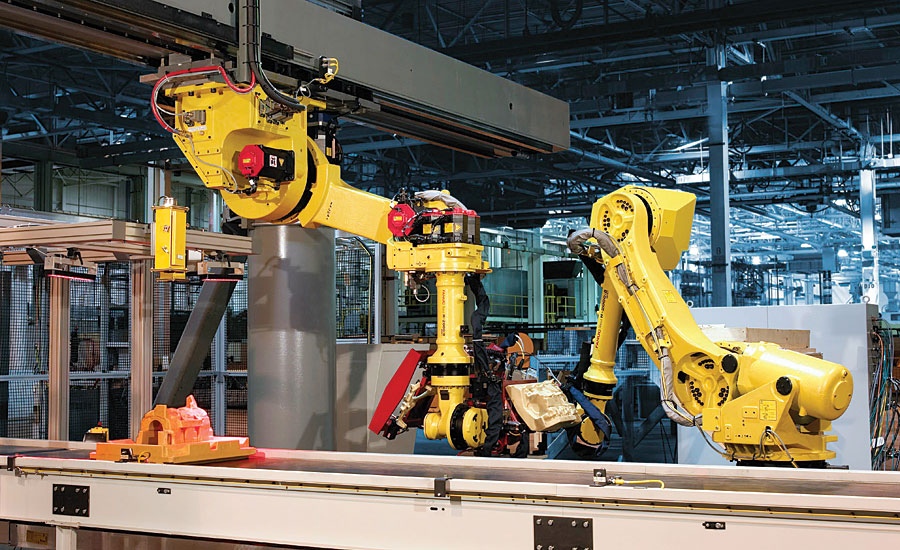

Industrial Robots in Operation

In terms of units, it is estimated that by 2020 the worldwide stock of operational industrial robots will increase from about 1,828,000 units at the end of 2016 to 3,053,000 units. This represents an average annual growth rate of 14% between 2018 and 2020. In Australasia, the operational stock of robots is estimated to increase by 16% in 2017, by 9% in the Americas and by 7% in Europe.

Since 2016, the largest number of industrial robots in operation has been in China. In 2020, this will amount to about 950,300 units, considerably more than in Europe (611,700 units). The Japanese robot stock will slightly increase in the period between 2018 and 2020. About 1.9 million robots will be in operation across Asia in 2020. This is almost equal to the global stock of robots in 2016.

Top Five Markets in the World

There are five major markets representing 74% of the total sales volume in 2016: China, South Korea, Japan, the United States and Germany. China has significantly expanded its leading position as the largest market with a share of 30% of the total supply in 2016. With sales of about 87,000 industrial robots, China came close to the total sales volume of Europe and the Americas combined (97,300 units). Chinese robot suppliers continued to expand their home market share to 31% in 2016.

South Korea is the second biggest market in the world. Due to major investments by the electrical and electronics industry in robots, annual sales increased considerably. About 41,400 units were sold in 2016. This is a rise of 8% compared to 2015. South Korea has the highest level of robot density in the world, about 630 robots installed per 10,000 employees in the manufacturing industry in 2016. Korea is a market leader in LCD and memory chip manufacturing. In Japan, robot sales increased by 10% to about 38,600 units (2016), reaching the highest level since 2006 (37,400 units). Japan is the predominant robot manufacturing country. Since 2010, the production capacity of Japanese robot suppliers has increased in order to meet the growing demand for industrial robots: production more than doubled from 73,900 units in 2010 to 152,600 units in 2016 (52% of the global supply in 2016).

In the United States, robot installations increased by 14% to a peak of 31,400 units (2016). The driver for this continued growth since 2010 was the ongoing trend to automate production in order to strengthen the competitiveness of American industries in overseas markets. Investments have been made to keep manufacturing at home, and in some cases, to bring back manufacturing that had previously been relocated overseas. Due to this dynamic development, the robot density in the United States increased considerably—in particular in the automotive industry. With a density of 1,261 installed robots per 10,000 employees, the United States ranked second in 2016 after the Republic of Korea.

Most of the robots in the USA are imported from Japan, Korea and Europe. Germany is the fifth largest robot market in the world and by far the largest in Europe. The annual supply and operational stock of industrial robots in 2016 had a share of 36% and 41% respectively of total robot sales in Europe. In 2016, the number of robots sold increased slightly to 20,039 units compared to 2015 (19,945 units).

Future Trend: Smart factory Industry 4.0—linking the real-life factory with virtual reality—will play an increasingly important role in global manufacturing.

As obstacles like system complexities and data incompatibility are overcome, manufacturers will integrate robots into factory-wide networks of machines and systems. Robot manufacturers are already developing and commercializing new service models: these are based on real-time data collected by sensors which are attached to robots. Analysts predict a rapidly growing market for cloud robotics in which data from one robot is compared to data from other robots in the same or different locations.

The cloud network allows these connected robots to perform the same activities. This will be used to optimize parameters of the robot’s movement such as speed, angle or force. Ultimately, the advent of big data in manufacturing could redefine the industry boundaries between equipment makers and manufacturers.

Future Trend: Small-to-medium-sized manufacturers will automate. Some robot manufacturers are also considering leasing models, particularly in order to accelerate adoption by small-to-medium-sized manufacturers. Simplification is a key trend for this market segment. The ongoing need for robots which are easier to use and to program and the increasing need for ever more flexible automation initiated the development of smarter solutions. This is especially useful for industries with a lack of specialized production engineers in-house. Thus, it is important to provide easy-to-use robots that can easily be integrated into and operated in standard production processes. Robots that are uncomplicated to use will enable the deployment of industrial robots in many industries to sustain efficient and flexible manufacturing.

For more information, visit ifr.org.