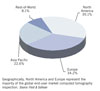

Aerospace and military applications lead the end-user market for computed tomography inspection. Source: Frost & Sullivan

The use of X-Ray inspection techniques for nondestructive applications dates back almost 100 years with the invention of high vacuum X-Ray tubes. Although the medical industry has traditionally been the largest driver for X-Ray inspection systems, both in terms of technology and implementation, it is interesting to note that the first use of X-Ray by Wilhelm Conrad Rontgen was intended for an industrial application. Rontogen’s discovery that X-Rays could pass through human tissue, but not through materials of higher density, soon led to a revolution in the world of science and medicine. It was not until 1912, about 17 years after Roentgen’s discovery, that the use of X-Rays broadened to include industrial applications with the invention of high vacuum X-Ray tubes designed by William Coolidge.

This trend continues today with the capabilities of X-Ray inspection systems reaching new heights and its use becoming more frequent and commonplace for industrial applications ranging from materials research, maintenance and repair, manufacturing and quality control. Technological advances in hardware, such as tubes, sources and detectors, as well as upgrades in software, have significantly improved the productivity and user-friendliness of X-Ray inspection systems. In a poll conducted by Britain’s Science Museum in 2009, in which nearly 50,000 votes were cast, X-Ray was recognized as the most important modern scientific achievement of the 20th century on a list of the top ten greatest achievements in science, technology and engineering.

With rapid advances in manufacturing technologies, material research and precision engineering, the industrial X-Ray inspection industry has had to evolve to accommodate the needs of its expeditiously developing customers. The growing need for increased productivity, quality and accuracy at lower costs has led to the industry witnessing a paradigm shift from analog to digital X-Ray technology. Led by advancements in the medical field, X-Ray technologies such as computed radiography (CR), digital radiography (DR) and computed tomography (CT) have seen accelerated development over the past few years. Amongst these three technologies, CT has witnessed sluggish demand since its introduction for industrial application. This article will provide a basic understanding of CT, factors currently driving its adoption and an outlook for the future.

Geographically, North America and Europe represent the majority of the global end-user market computed tomography inspection. Source: Frost & Sullivan

CT: Back to the Basics

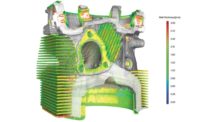

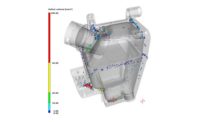

CT is a radiographic inspection method that utilizes a computer to generate a three-dimensional image of the internal structure of an object under test. A general CT process consists of acquisition, correction, reconstruction and viewing the result or post-processing. Acquisition consists of rotating the test object, 360 degrees, on a turntable to procure a set of high resolution radiographs. This set of radiographs then undergoes geometrical correction to account for a few non-linearities introduced by the imaging device. Reconstruction is the most important part of the CT process, wherein the set of individually corrected radiographs are combined to obtain the three-dimensional image. The reconstruction of the radiographs is done with the help of advanced software that also displays the final image. This image can be processed further to obtain the desired result.Lukewarm Industry Acceptance

Initially, in the late 1980s, when CT systems were first used for industrial applications, the main hindrance for its wide-scale market adoption was price. CT inspection systems are among the most expensive nondestructive techniques, with prices ranging from $90,000 to as high as $2 million. The prices are directly related to the capabilities of the system. Entry level CT systems equipped with a 130 kV tube are usually available for less than $100,000, while a 450 kV CT system could cost between $500,000 and $2 million. Although prices of CT inspection systems have dropped, the reduction has not been significant enough to be affordable to the lower tier of end-user industries such as automotive, manufacturing and electronics.Also, CT has been described by many experts as a cumbersome, slow and difficult-to-use technique. For the most part, dependence of CT on the computational powers of a computer can be held responsible. CT is a very data-intensive process, as a result of the detailed level of its analysis capabilities. This makes CT inspection a relatively slow technique and not suitable for production environments. To put things in perspective, a typical CT configuration acquires 720 projections to produce 512 cross-sectional images, each 512 by 512 pixels. Hence, there are nearly 100 billion calculations, each requiring several basic math operations. An advanced CT configuration often-used is 1,440 projections and 1,024 cross-sectional images, each with 1,024 by 1,024 pixels, requiring 1.5 trillion calculations. The shear volume of calculations places significant burden on the computer. As a result, acquiring a CT image could take a number of hours.

Since the time taken to obtain an image is usually not of critical importance in the medical field, CT has become a standard form of X-Ray. However, for industrial applications, there are severe constraints on time and costs and CT had fallen behind in comparison with other X-Ray technologies. In the past few years, however, advances in computer technology and the reconstruction software have helped reduce the time needed for obtaining a CT image. But, the process is still sluggish in comparison with the productivity gains of DR and CR, which limits the number of applications it can be used for.

Potential Applications

Previously restricted to laboratory environments, advancements in software have resulted in CT systems moving out of the realm of R&D applications and into more non-traditional markets. Currently, CT is being used extensively in homeland security, for inspection of baggage at airports. It is also being used by the military for missile inspection and small-scale failure analysis. The aerospace industry is utilizing the benefits of CT for crack analysis in components and turbine blade inspection.With considerable improvements in scan speeds, CT systems are expected to be made available for production-line inspection applications. Although, constraints in current instrumentation limit the use of CT in production line testing, within the next five years, conformance with quality standards and 100 percent automated inspection at production line speeds is within the realm of possibility.

An important niche in this industry is expected to be 4-D computed tomography, a technology that is an integral part of the medical imaging community. Bringing the time dimension into consideration, 4-D CT is expected to enhance real time monitoring capabilities. Also, the ability of 4-D CT to capture a full range of motion of critical internal structures will propel this technology in the future.

Market Overview

Although, CT systems were introduced into the field of industrial inspection more than a decade ago, it’s only in the past five years that this segment has really come into prominence. A highly successful imaging technique in the medical field, it was only a matter of time before CT systems became an essential part of the nondestructive testing market. CT systems are currently a high growth area for X-Ray inspection systems with rapid changes and enhancements in technology compared to other industrial imaging techniques. These advancements in technology have rapidly improved the speed, cost and user-friendliness of CT systems, which in the past were meant only for high-end laboratory applications.Frost & Sullivan research into the global CT inspection system market for industrial applications valued it at around $150 million in 2010. The market is expected to grow at a compounded annual growth rate (CAGR) of 8 percent. This is considerably impressive since the overall global X-Ray inspection systems market is expected to grow at five percent CAGR.

From an end user perspective, aerospace is the highest revenue generator. Complex manufactured components in the aerospace industry, used for safety critical applications, require high-end inspection techniques. Components with complex shapes such as turbine blades, rotor blades and fuel nozzles cannot be effectively inspected for flaws and cracks by ordinary NDT inspection tools. Several aircraft components are subjected to harsh environments and are expected to have a shelf life of more than 20 years. Powerful inspection tools that are used throughout the life cycle of the product right from materials research, optimization of the production process and maintenance and repair is essential for the aerospace industry.

The use of CT systems in the electronics end-user segment is growing. The integration of microfocus and nanofocus tubes with CT systems enables the inspection of components such as printed circuit boards (PCBs), integrated circuits (ICs) and high-density BGA chips. Microfocus/nanofocus X-Ray inspection has become the most widely-accepted method in controlling the quality of board assemblies, and in analyzing the defects associated with hidden solder joints such as insufficient reflow, faulty paste print, extraneous voiding and bridging.

Conclusion

As with other X-Ray techniques, technological advancement is driven by the medical industry. The shear size of the medical industry-and its willingness to embrace newer technologies-results in high R&D investment to eradicate flaws in the technology. The NDT industry is a direct beneficiary of these advancements. The technology developed for medical applications of course has to be tweaked to suit the harsh environments the X-Ray system is subject to in production environments.Another factor that has contributed to the popularity and growth of CT as an inspection technique has been the effort taken by X-Ray instrumentation vendors to promote the capabilities of this technique and improve awareness of the end-user. There have been several product introductions with enhancements and refinements to existing CT capabilities from leading CT vendors such YXLON, North Star Imaging, phoenix X-Ray, Nikon Metrology and Dage.

Considering the various advantages of CT, it is expected to expand significantly over the next five years, in terms of technology, application and revenues.NDT

Nikhil Jain is Measurement & Instrumentation Research Associate for Frost & Sullivan. E-mail: [email protected] .