It’s the year of the supply chain challenge. For many manufacturers, 2022 will be remembered as the year they couldn’t get parts or components without long lead times. This was a top job barrier for many, along with current events including the war in Ukraine and the economy/inflation as well as ongoing issues with labor shortages.

The 2022 Quality State of the Profession looks at issues affecting manufacturers today. This year continues to be an unusual one. While COVID-19 has subsided as a top concern, supply chain disruptions are the current source of stress.

Clear Seas Research, in conjunction with Quality, conducted the State of the Profession study in order to provide detailed information on professionals involved in quality operations. As usual, the goal was to determine trends in employees’ compensation, work hours and job constraints; overall job satisfaction; improvements to quality operations; and demographic profile of industry professionals.

Let’s see what your peers have been up to in the past year. And if you’d like a more detailed look at the survey, please visit our new dashboard.

Respondents

The respondents were a very experienced group on average, with a mean of 23 years in the industry. More than three-quarters of the group supervise ten people or less (with a mean of seven people).

Three-quarters of respondents are involved with components/parts manufacturing or original equipment manufacturing. Respondents manufacture products for various industries, with aerospace parts and products coming in at the top spot (29%), followed by medical equipment and supplies (27%), and transportation equipment (23%).

In terms of company revenue, 32% of respondents reported more than $100 million in 2021 annual revenue and 38% reported revenue between one million and $24.9 million. The median company revenue is $26.5 million.

More than three-in-five of respondents’ companies employ 500 or fewer employees including all locations. The size of the quality staff remained mostly consistent during the past year though 41% of respondents expect their quality staff team size to increase in 2022.

Following the United States, Mexico (28%) and China (27%) are the countries most likely to have production facilities. Nearly half of respondents’ companies have production exclusively in the United States. For those who have other production locations, they have an average of four locations.

Top Concerns Today

Supply chain interruptions (71%), skilled labor shortages (61%), and the current economy/inflation (50%) are expected to be the top job barriers in the next 12 months.

Thirty-nine percent of respondents said supply chain interruptions would have the greatest impact on their business. “The components that are missing in action are so random in nature, it’s very difficult to devise a plan,” said one respondent. “If it were, for example, a fuel shortage, we could plan for that and get agreements in place. But what we have now is an inexplicable shortage of a chemical, or paper or something unexpected like that.”

While labor shortages have been a long-time challenge, it remains a top concern today, with 25% of respondents citing it as the top barrier. As one respondent said, “We are severely understaffed by 15 to 20%. This is dramatically impacting the amount of parts that we can provide to meet our customers’ demands.”

The current economy/inflation was the top concern for nine percent of respondents. “It has an effect on every single aspect of our business,” said another respondent. “The cost of every single thing involved in our business is skyrocketing. It is frightening.”

The job overall is the most important factor that contributes to their job satisfaction (89%), followed by pay for the job done and their company’s commitment to quality (both at 82%), and work environment (78%). Corporate leadership (77%), benefits package provided (75%), and opportunities for advancement (59%) were the other important factors contributing to job satisfaction. More than three-quarters of respondents are satisfied with their job overall.

Workforce skill improvement emerges as the largest job-related concern. Economic conditions, management support, and salary are also perceived to be top concerns.

Salary, Recruitment, Satisfaction

Salary is always an ongoing area of concern. On average, respondents draw an annual salary of about $100,000. Of the nearly two-thirds of respondents who receive an annual bonus, the average amount is about $8,000.

More than three-in-five respondents report a salary increase compared to the past year, on average by five percent. Three-fifths of respondents expect a salary increase at their next performance review.

Companies are recruiting talent mainly through word-of-mouth, job search engines/boards, company websites, temp agencies/recruiters, and/or internal recruitment. Only seven percent are currently not recruiting.

The majority of respondents are likely to recommend quality manufacturing as a future career, citing reasons such as the growing field, diversity of work, and importance of the work in all industries. One respondent cited the constantly improving technology and the excitement involved in implementing it, writing, “I have worked 40 years in this field and am still constantly learning new technology.” Another said, “Manufacturing has never been more important. People are moving away for low quality bargain products to more future proof -IoT/smart products with fast delivery and quality support post-sale.”

For the minority who would not recommend it as a career, the negatives outweighed the positives. “Current society does not create an environment where quality professionals are respected,” said one respondent. “It is often a thankless job, made difficult by things that are beyond an individual’s control.”

Training And Technology

For a field that values continuous improvement, respondents are also working on improving their own skills. Nearly all respondents (96%) have taken at least one job-related training in the past 12 months. Among training opportunities offered by trade associations, ASQ is the most common, followed by SME.

More than half of respondents believe a hands-on training/experience is the most valuable type of education for a job in the quality manufacturing space.

Respondents are most interested in developing their programming, data analytics, CAD/3D modeling, and/or robotics related skills in the next year.

Respondents believe their companies should focus most on pay increase, improving training, hiring new labor, and/or improving quality assurance over the next year.

One way to improve, of course, is adopting new technology. Technology trends are always an area of interest—it just depends on how quickly companies are willing to try new things themselves. More than half of respondents report that their companies are currently using automation and/or cloud computing, followed by more than one-third reporting use of additive manufacturing, robots, and/or digitization.

Survey Details

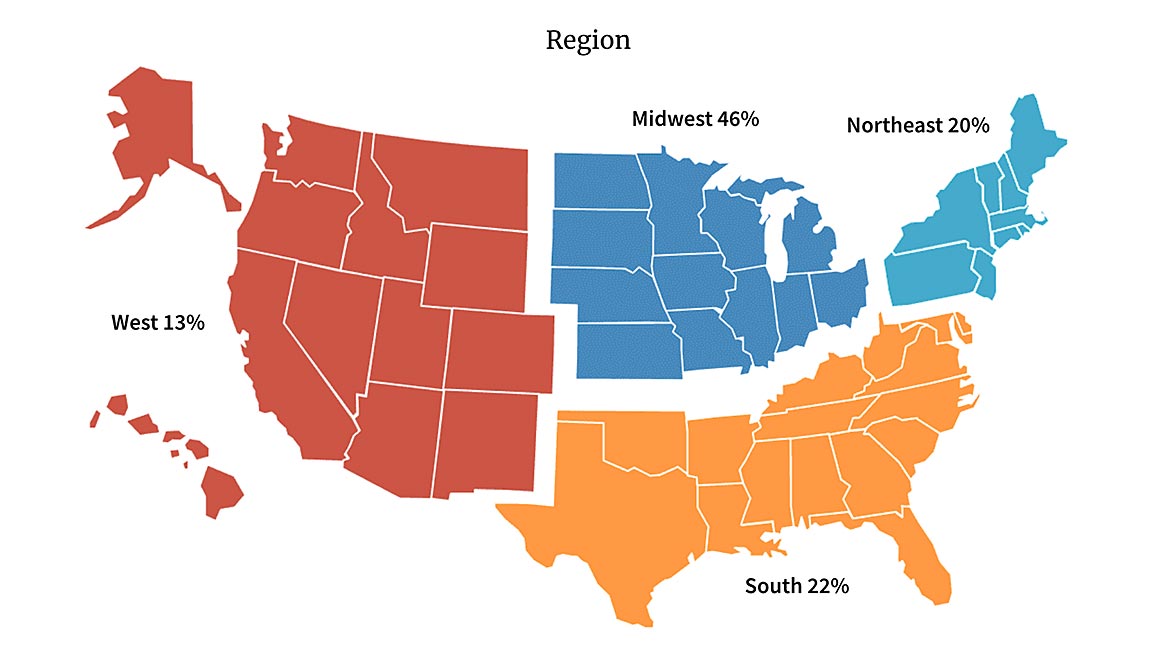

If you’d like a closer look at who responded to the survey, here are the details. Similar to years past, the mean age is 54 years old, and 85% are male. Forty-nine percent have a bachelor’s degree. The largest group (46%) are located in the Midwest, followed by the South at 22%, the Northeast at 20%, and the West at 13%.

As with many things the past few years, timing matters. This year’s survey was conducted April 13-15, 2022. We received 204 useable responses for a response rate of 1.14%. Each respondent received a $10 gift card. Thank you to all those who completed this year’s survey. We appreciate you sharing your insights with us and your peers in the industry.