Would it shock you to learn that spending on artificial intelligence is on the rise? According to respondents of our Annual Quality Spending Survey, 55% of companies expect to increase their spending on AI for 2024.

No discussion of spending would be complete without automation and artificial intelligence so we’ve added these to our latest survey. Forty-six percent of companies say they are using automation now, while 8% are currently using AI.

Clear Seas Research, in conjunction with Quality, conducted the 23rd Annual Spending Study in order to determine actual spending for quality assurance and control equipment, systems, software, and services compared to the projected/budgeted amount as well as the change in budget allocation within quality equipment and service categories.

The Results Are In

The top manufacturing operation performed at respondents’ location is assembly (67%), followed by machining (59%).

Respondents come from locations with an average of 354 employees, with the bulk of company locations (7 in 10) employing fewer than 250 employees at that location.

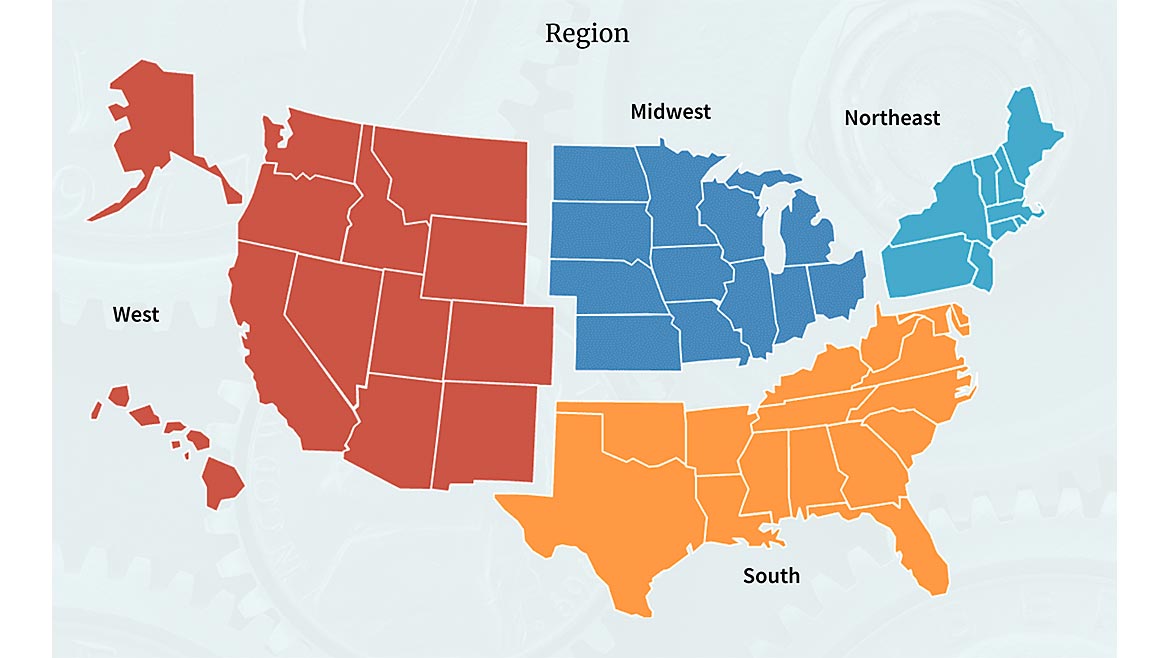

Where are they working? These locations ranged across the U.S. This year 44% of respondents came from the Midwest, followed by 23% in the South, 19% in the Northeast, and 15% in the West.

And what are they making? Aerospace products/parts, fabricated metal products, and medical equipment and supplies top the list for respondents.

And who are they? Quality management roles were the top job function, cited by 34% of respondents. Next up came quality engineering, manufacturing engineering, manufacturing management/operations, and research and development. Corporate management, technical engineering, and purchasing rounded out the list.

Nearly half of respondents are at least very familiar with their company’s fiscal 2024 budget. The survey was fielded September 27 to October 10, 2023. At that time, three-in-five respondents reported their 2024 budget had already been started.

The Outlook

What’s concerning quality professionals this time around? The top three concerns were the current economy/inflation, skilled labor shortages, and supply chain interruptions.

The next concerns revolved around business stability and goals. Respondents were concerned about achieving business goals over the next six months, business stability for the next 12 months, and achieving business goals over the next three months. The final concerns mentioned were employees not showing up for work and IT cybersecurity with remote employees.

The Importance Of Quality

Quality is important to the Quality audience, it just varies by degree. Forty-eight percent said the importance of quality has increased in the last year, while 49% said it stayed the same. Only 3% said it was less important.

In looking at the accuracy of budget projections, 63% said their actual spending matched projected spending. Nineteen percent of respondents reported that their 2022 actual spending was over budget, on average by 17%. About the same proportion (18%) stated that their spending was under budget, on average by 26%.

For their 2023 budgets, 71% anticipated their 2023 budgets would match their projected budget. Fifteen percent said they expected to be over and 15% also expected to be under budget.

For 2024 budgets, 46% expect it will remain the same, 44% anticipate an increase, and only 10% expect a decrease.

Seventy-one percent expect to make their first purchase of the fiscal year in the first quarter. The largest group (27%) expects to make that purchase this month.

What’s driving this spending increase? For those who anticipated an increase in their 2024 quality assurance/equipment/service budget, their top five reasons included: replacing equipment, improving productivity, reducing scrap and rework, reducing costs, and increasing production capacity.

Spending often has many goals attached. Other motivations were: improving cycle time, ramp up for new product, tighter part quality standards, comply with ISO quality systems, enhance machine/process flexibility, regulatory compliance, and implement lean manufacturing. Only three percent said it was none of these.

The inspection approach has remained fairly consistent over the years. Lot sampling is the most common approach to incoming and in-process testing. When it comes to the final product, companies are typically more stringent. Forty-seven percent of respondents’ companies test/inspect every part or product during final inspection.

Looking At The List

Let’s look at what respondents plan to buy. For the past four years, 66% of respondents said their companies plan to purchase general-use test/measurement/inspection equipment in fiscal 2024. Gages and gaging systems were right behind at 65%. These are typically the top two purchase categories.

The main product categories look consistent overall, and 96% of respondents plan to purchase something from these categories. Test, measurement and inspection services are on the list for 54% of respondents.

Product testing equipment was mentioned by 47%, followed by software by 42%, automation by 39%, consulting and training services by 38%, optical inspection and measurement equipment by 38%, materials test equipment by 36%, and nondestructive testing equipment by 33%. Next up was form and surface measurement equipment, cited by 22%.

Nineteen percent planned to purchase a CMM, 17% color and coatings thickness equipment, and artificial intelligence rounded out the list at 12%. Only 4% said they didn’t plan to purchase any of these items.

Product Categories

Now let’s look at little closer at these product categories. Among the 19% who plan to purchase a CMM, almost half expect to spend $100,000 or more on this item in 2024.

For those shopping for form and surface measuring equipment, 26% of respondents budgeted less than $5,000 for this category. Twenty-percent budgeted between $5,000 and $9,999. Thirty-eight percent expect this budget to increase for 2024. Gages and gaging systems are a staple for quality professionals, with the need remaining steady.

Budgets for gages and gaging systems for 2023 and 2024 are similar with around three-in-four respondents budgeting under $60,000. In 2023, an average of 30% of gaging budgets will be spent on handheld measuring tools.

The 2023 optical inspection and measurement equipment budget was less than $10,000 for 30% of respondents. Almost three-in-five respondents predict that their plant’s 2024 budget for this equipment will remain the same as budgeted in 2023. Almost one-third expect an increase. Optical comparators (21%) and machine vision (19%) top this spending category.

Seventy-seven percent of respondents predict that their plant’s spending for color and coatings thickness equipment will remain the same as budgeted in 2023. Sixty-one percent of respondents’ companies budgeted less than $5,000 for this equipment in 2023, and spending for 2024 is predicted to be similar, though 16% do anticipate an increase.

Sixty-percent of respondents expect their 2024 spending on product testing equipment to remain the same as their 2023 budget, while 28% expect to see an increase next year. Less than half of that (13%) expect this budget to decrease.

Seventy-percent do not expect to see a change in materials test equipment in 2024. Twenty-five percent predict an increase, and only 5% predict a decrease. Of the materials testing categories, hardness testing and chemical analysis topped the list, each at 13%. Universal testing machines, tensile testing, force testing, fatigue testing and metallography followed.

About 65% of respondents anticipate spending for nondestructive testing equipment to remain the same in 2024 as in 2023. Thirty-six percent budgeted less than $10,000 for this equipment in 2023. The primary types of NDT equipment for 2024 budgets are dye penetrant, ultrasonic testing and magnetic particle inspection.

Sixty percent of respondent companies budgeted less than $40,000 for general-use test, measurement and inspection equipment in 2023. This is similar to predicted spending in 2024 for most companies. Calibration equipment was the largest category for this type of equipment, coming in at 50%.

No matter what type of equipment you have, you need software. And it’s probably time to invest in more of it, according to our respondents. Forty-three percent of respondent companies budgeted less than $20,000 for software applications in 2023. Fifty-four percent of companies expect this budget to increase for 2024.

What type of software are you looking for? Data collection, enterprisewide quality software, and calibration top the list for our respondents.

Consulting and training services remain important as well. Sixty-five percent of respondents predict that their plant’s spending for consulting and training services will remain the same as budgeted in 2023, though 28% expect an increase. Over half budgeted less than $20,000 for these services in 2023.

On average, 22% of the budget for consulting and training services will be spent on certification/registration (such as ISO 9000) in 2024. Quality management (15%) and process improvements (14%) rounded out the top three. Lean manufacturing (8%), advanced product quality planning (APQP, 6%), Six Sigma (6%), and NDT training and certification (6%) were next. Geometric dimensioning and tolerancing (GD&T), statistical analysis, and failure modes and effect analysis (FMEA) each came in at 4%. Gage R&R, quality functional deployment, and design of experiments finished the list with 2% each.

Sixty-nine percent of respondents expect test, measurement, and inspection service spending in 2024 to be in line with the 2023 budget, while 21% of respondents expect to see an increase in 2024.

The largest category of the test, measurement and inspection services budget—calibration services—has remained consistent since 2020, accounting for an average of 36% of test, measurement and inspection services. Other categories include lab testing, materials testing, contract part inspection and measurement, environmental testing, failure analysis, and prototyping/reverse engineering.

In looking at the new category of automation, 52% expect the 2024 budget to remain the same as the 2023 budget, though an increase is in the cards for 38% of respondents.

It would be surprising if spending on AI wasn’t expected to increase. According to respondents, half of their companies budgeted less than $10,000 for AI in 2023, but 55% of companies expect to increase their spending on AI for 2024. In 2024, thirty-nine percent of respondents said they will be spending on automation, and 12% on artificial intelligence.

Methodology

The survey was sent to domestic active qualified subscribers of Quality. Each respondent that participated in the study received a $20 gift card. Thank you to all those who participated.